Relax, we’ve got the budget all worked out…

The end of the tax year can be a busy time, and you’ve got more than enough to worry about. We’ve been working hard behind the scenes to make sure we’re ready for all the Budget 2018 changes we need to make to ensure your clients enjoy the same unparalleled level of accuracy as we’ve been delivering since 1984.

We’ve got all the relevant changes covered, so you can focus on delivering fantastic outcomes for your clients…

UK Rate Changes

We’ve got all the rate and allowance changes covered, from the CPI indexation of the Lifetime Allowance (up to £1,030,000) to NI and Income Tax changes. The Dividend Allowance will drop from £5,000 to £2,000.

The Main Residence Nil Rate Band will increase to £125,000 for those leaving Main Residences to direct descendants (for those with estates under £2,000,000).

Income Statement and Scottish Rate of Income Tax (SRIT) changes

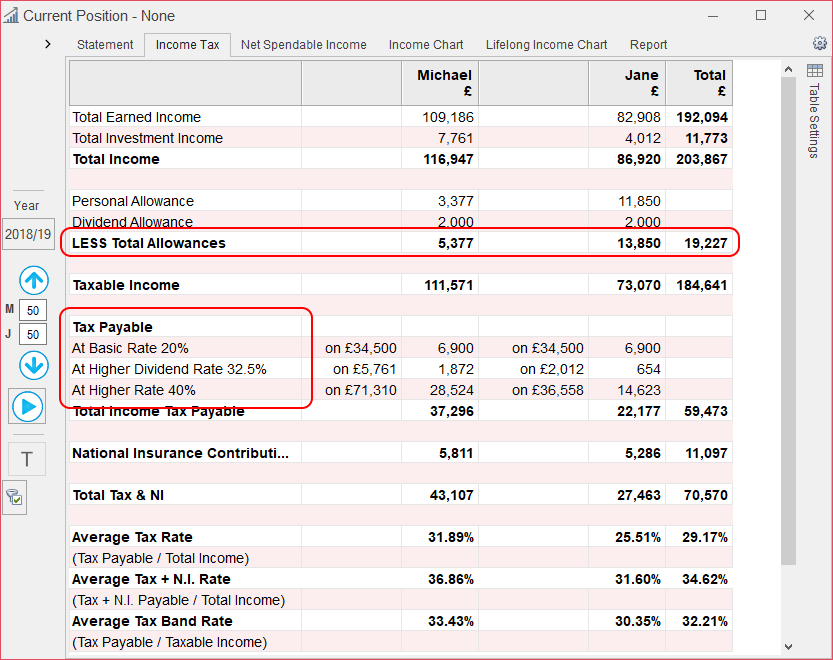

We’ve tweaked the Income Statement to make it easier to read – totalling Allowances and giving the Income Tax bands “friendly” names:

Rather than just showing the rate of tax, we now tell you the name of the tax band. This also helps with…

SRIT

For those with no clients north of The Border, please bear with me!

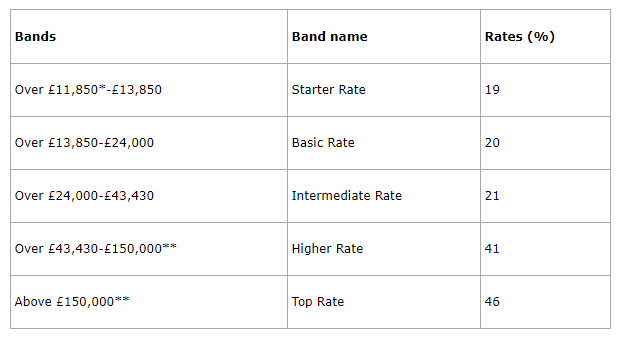

SRIT will be chargeable from 06/04/18 at the following rates:

Image credit – www.gov.scot

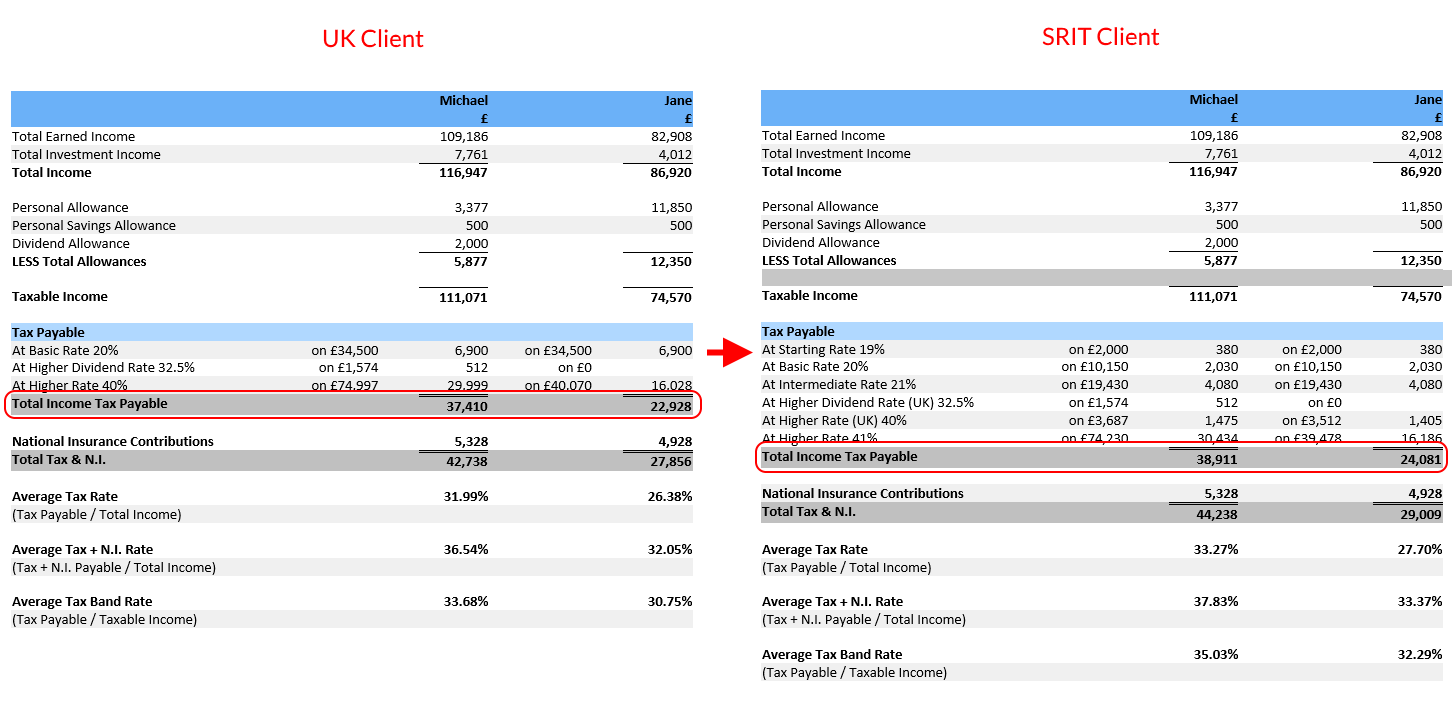

If your client pays SRIT, you can specify this in their Personal Details. We’ll then automatically apply the above tax rates (from 6th April 2018) to any non-dividend, non-savings income. Here’s the same client, paying UK tax (on the left) and SRIT (on the right):

Please check our Release Notes for full details of the latest changes.