Cracking down on recycling…

Recycling’s a terrible thing. At least, that is, when you’re planning for the MPAA reduction!

It turns out that while the Government are all in favour of turning old glass, plastic, and metal into new stuff, they aren’t so keen on people getting tax relief twice on the same money.

When pension freedoms were introduced in April 2015, the Government decided that anyone enjoying these freedoms would be subject to a reduced Annual Allowance. Rather than being able to contribute up to £40,000 a year into pensions, they would be limited to the Money Purchase Annual Allowance (MPAA) of £10,000.

Now, in an attempt to crack down on the crackdown, the Government have pledged to further reduce the MPAA to £4,000. But what does this mean for your clients, and how can you help them prepare for this latest change?

Will my client be affected?

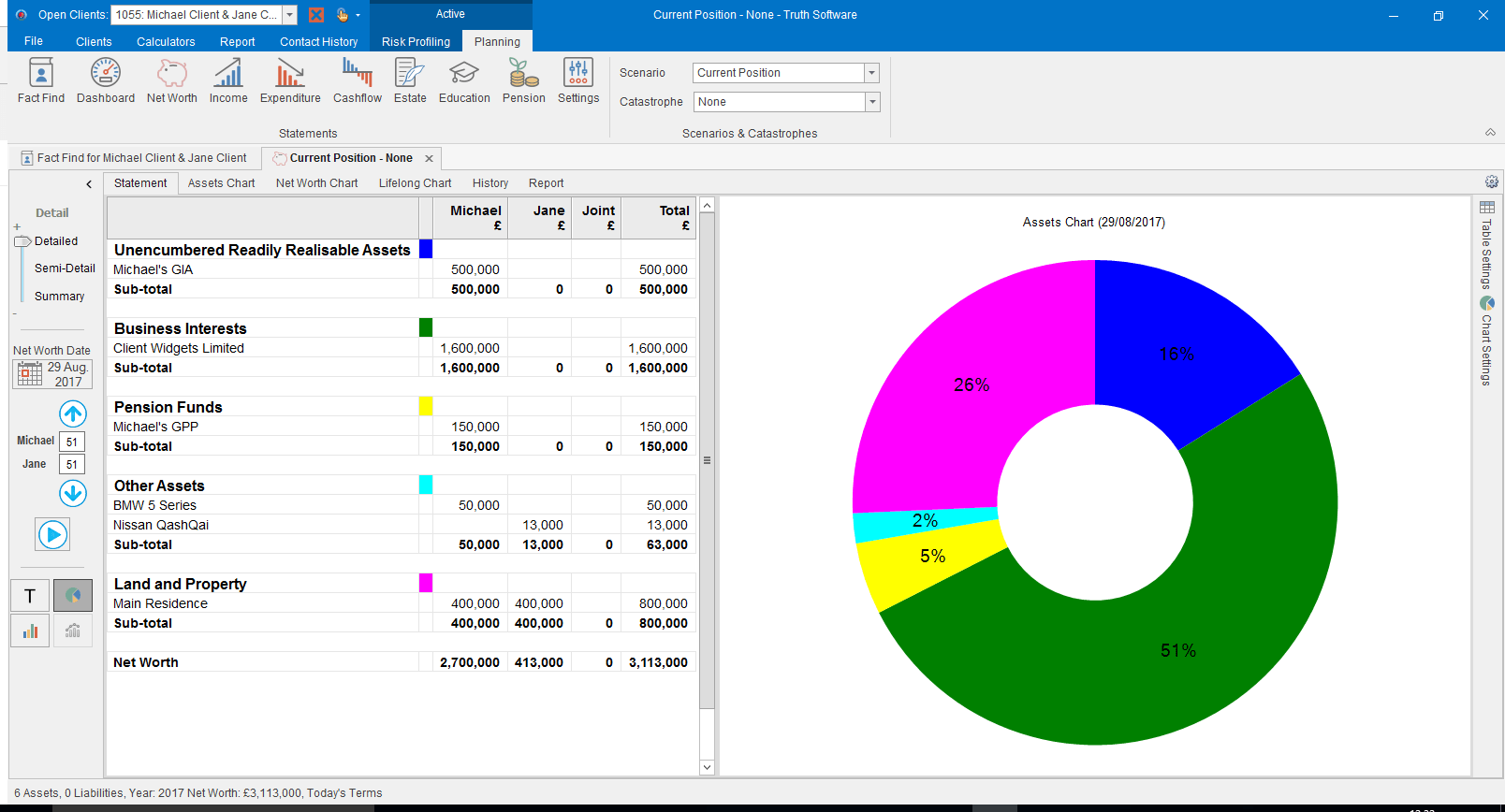

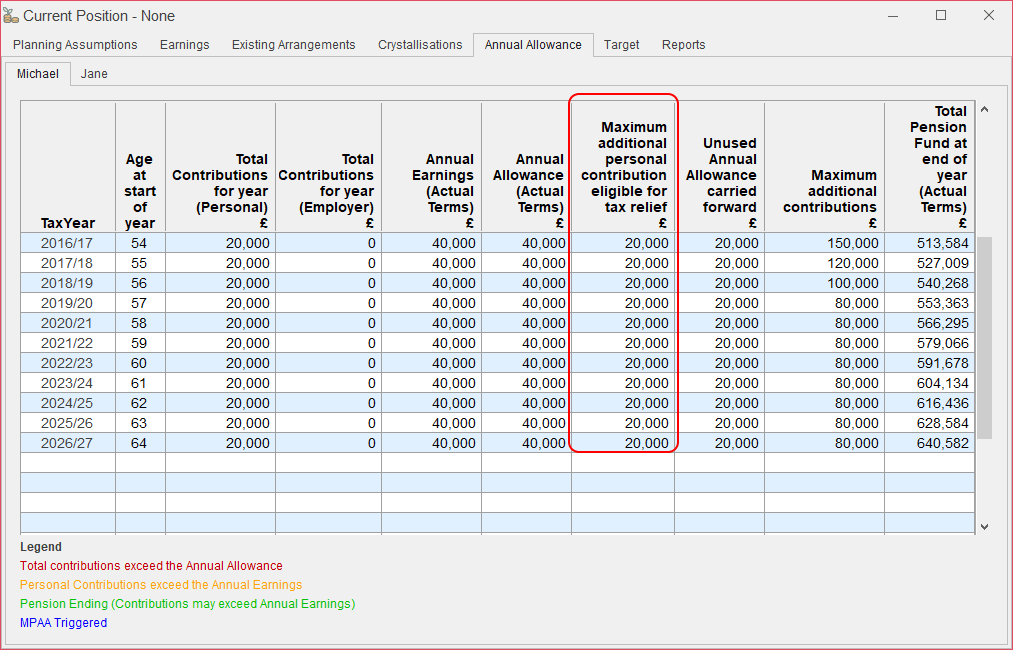

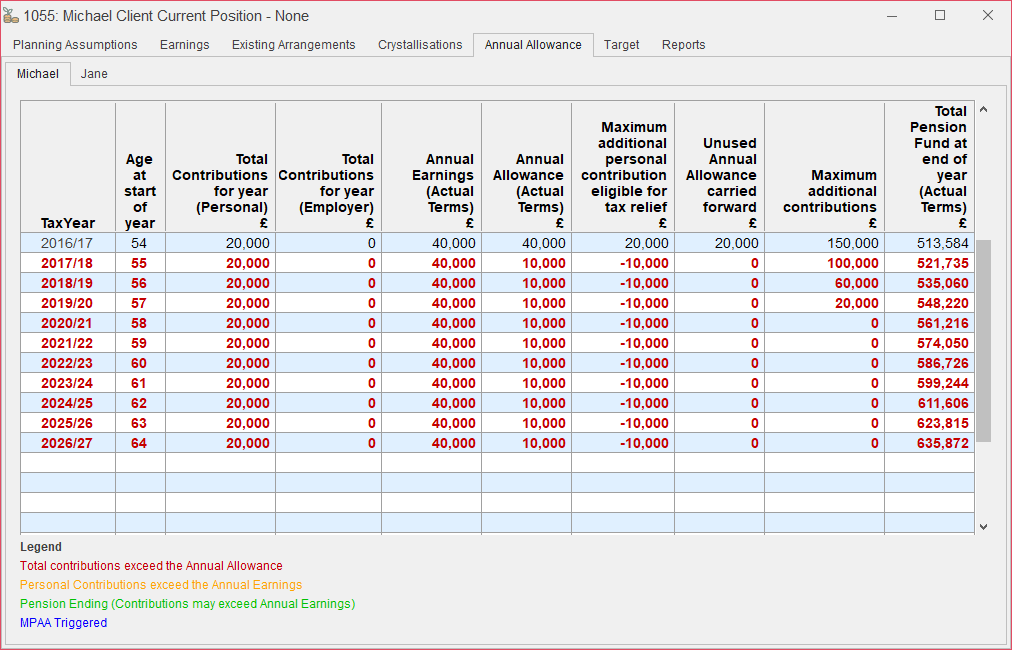

This is the Pension Statement in Truth. It shows the value of the client’s current pension contributions, and the value of additional contributions they can make in the current tax year.

This client is 55 years old, their Annual Allowance for pension contributions is currently £40,000. They plan on contributing £20,000 a year to their pension up to age 65 and, as you can see, they could contribute up to a further £20,000. N.B. – if the client earned below £40,000, Truth would automatically restrict their contributions to 100% of Net Relevant Earnings.

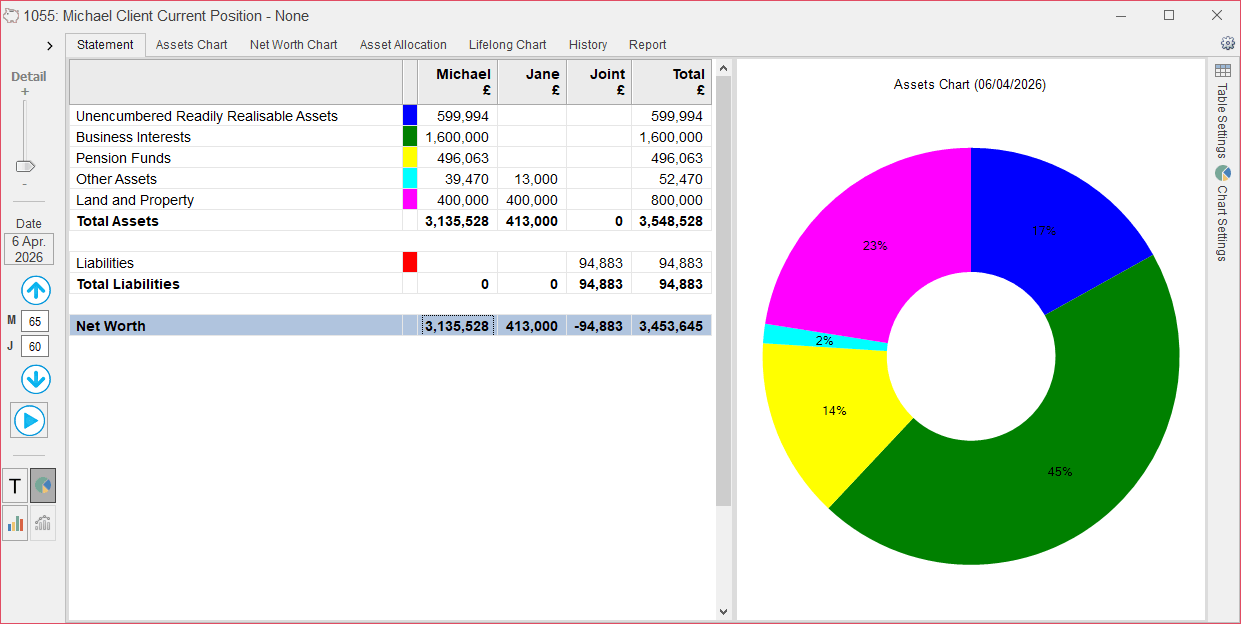

Here’s their Net Worth statement at age 65. We can see that their pension fund (show in yellow) will be worth £496,000.

Let’s see what happens when they enter flexible drawdown…

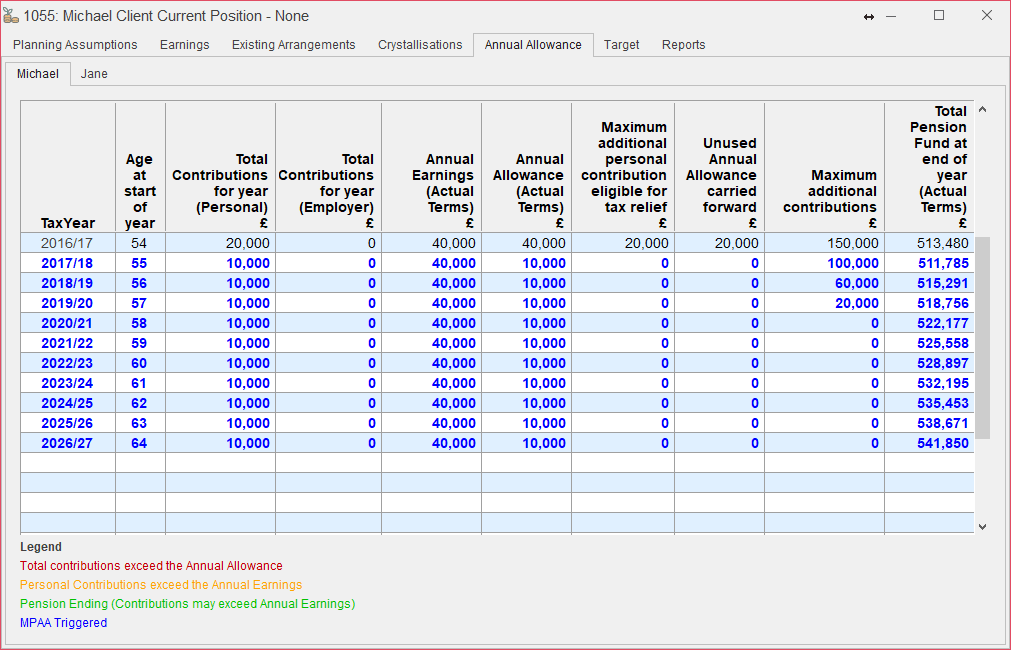

As you can see, Truth has recognised that the client is flexibly accessing pension benefits, and so applies the MPAA (currently £10,000). They are immediately over-contributing by £10,000 in the current year.

Fixing it for now…

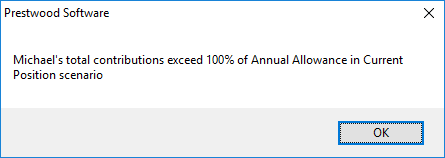

Whenever a client exceeds the Annual Allowance, or the MPAA, Truth notifies you of this whenever you access their record by displaying this message.

If your client were to take out Fixed Protection, we would automatically stop all pension contributions. However, as the MPAA applies across all pension funds, we don’t limit or restrict existing contributions.

In order to prevent your client from exceeding the MPAA, you will need to take the same remedial action you would take in real life: reduce or stop their pension contributions.

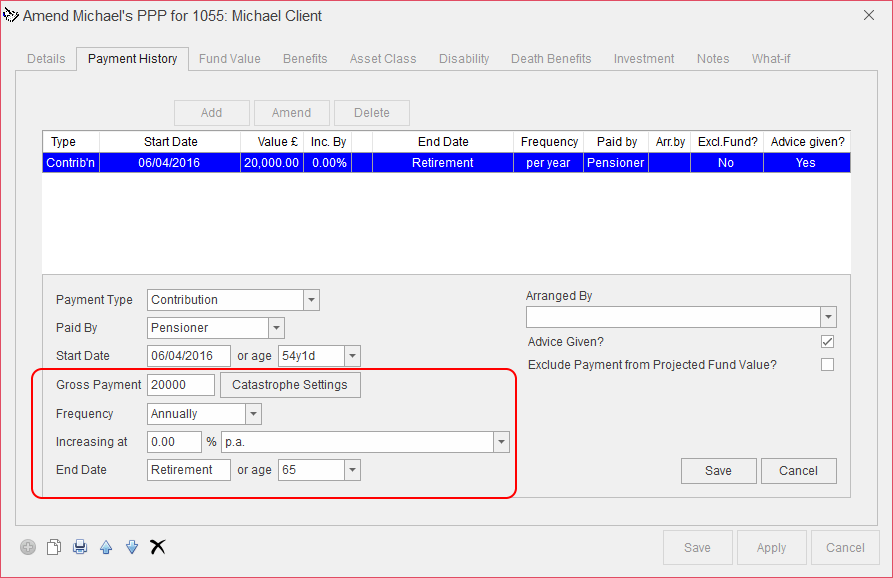

This is our Payment History tab. You can see here that this client is making a £20,000 ongoing contribution to their pension. They’re intending to stop contributions at age 65.

Let’s see the effect on the pension statement of reducing this annual contribution to £10,000 from this year until age 65.

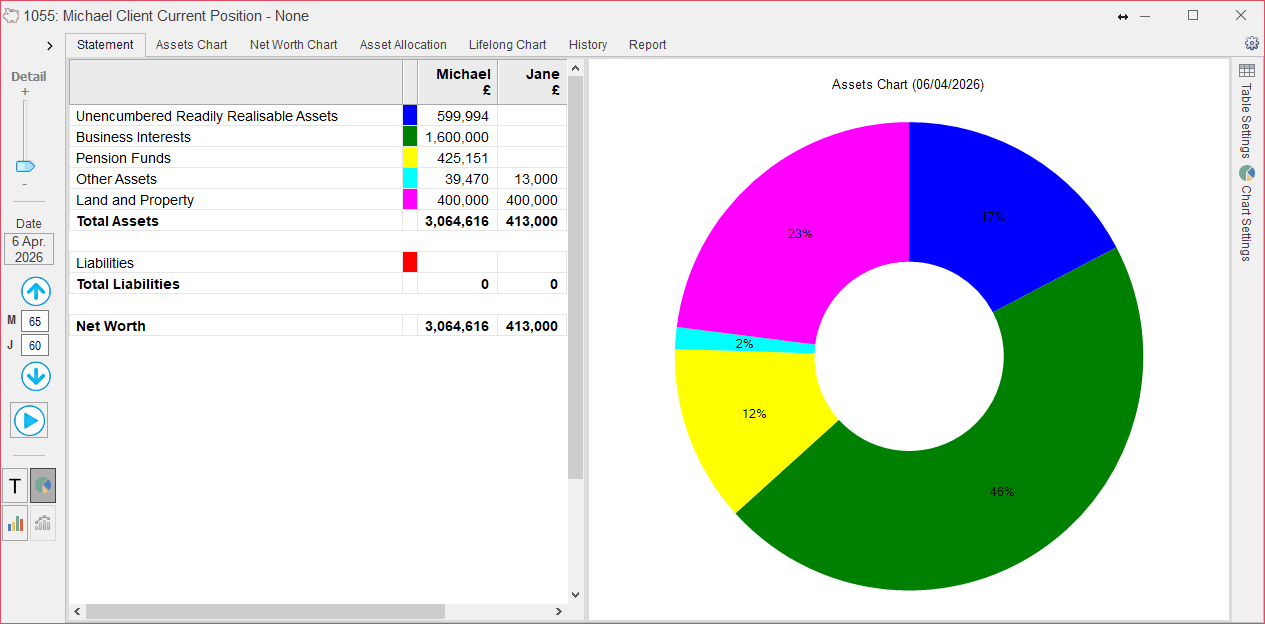

And on the Net Worth statement we can see that, at age 65, their pension fund will be worth £425,000.

…and fixing it for later

But what, I hear you say, about the impending changes? How does Truth help me planning for the reduction in the MPAA?

When legislation is passed as law, we incorporate it into Truth immediately. When the MPAA is formally reduced (on 6th April 2018), what you’d see on our pension statement is the MPAA automatically kicking in at its new value (£4,000).

Governments have a habit of changing their mind, especially when it comes to pensions legislation. As a result, we don’t release changes until they’re formally passed as law. But that doesn’t mean you can’t plan for them.

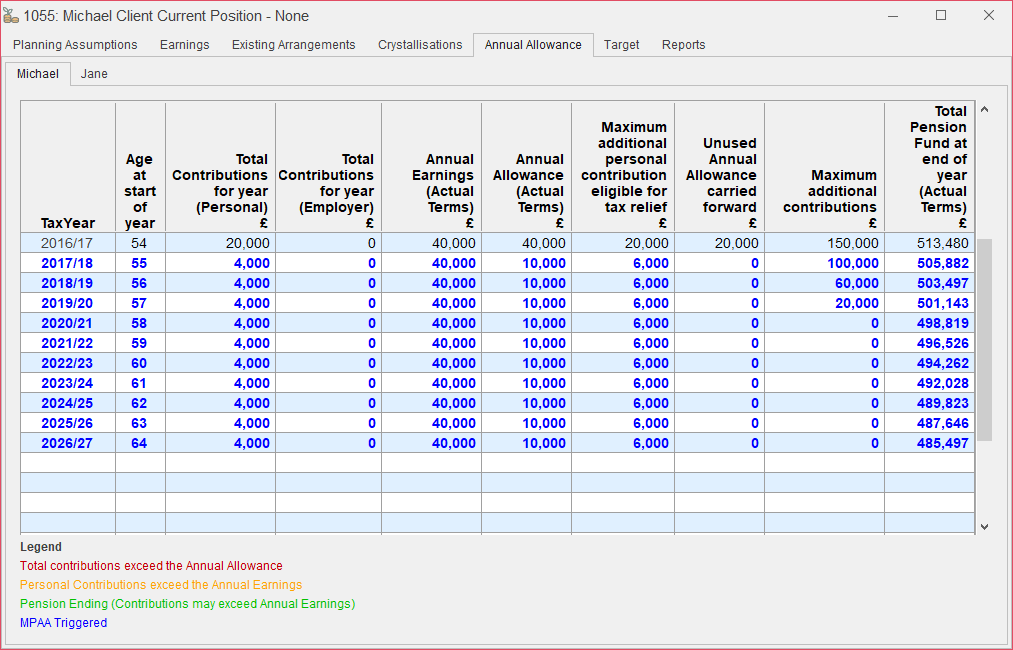

The Government’s current position is that the MPAA reduction will be applied retrospectively from April 2017. By reducing this client’s contributions to £4,000 per annum from the current financial year, this is how their pension statement appears:

Assuming the Government go ahead with their plans to reduce the MPAA, this client will be fine. If the change is abandoned once again, they will be able to contribute a further £6,000.

Truth allows you to build in this kind of flexibility, and to see the impact on both the client’s pension fund, and their lifelong cash flow. We can immediately see the impact of any changes, and how they impact on the client’s plans for the rest of their life.

In this case, Michael and Jane can rest assured that they can conform to the new MPAA without jeopardising their desired future lifestyle. Can your clients say the same?