Buy-To-Let income tax relief

Profits, Allowable Expenses & Finance Cost Relief are now calculated automatically for Rental Properties.

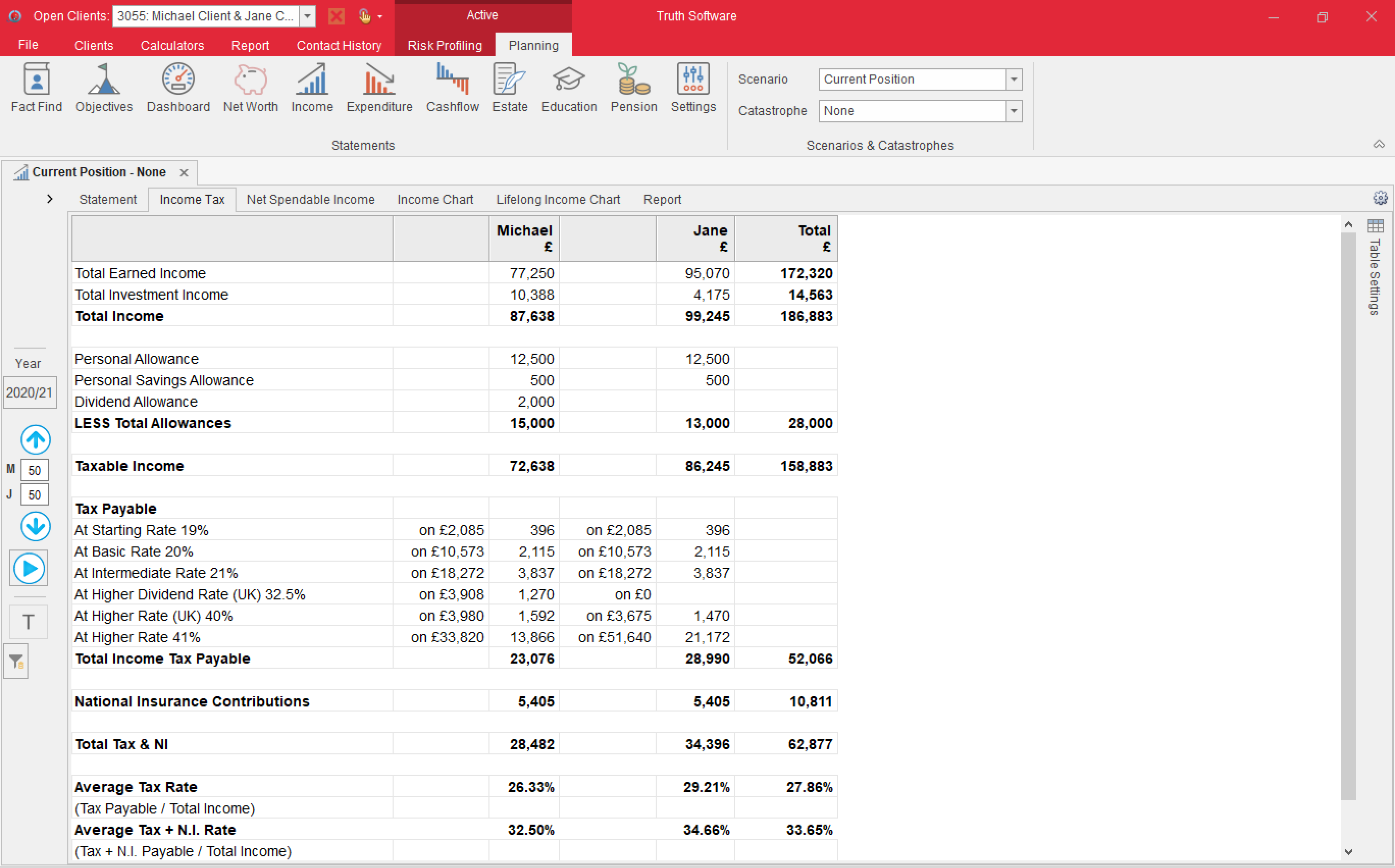

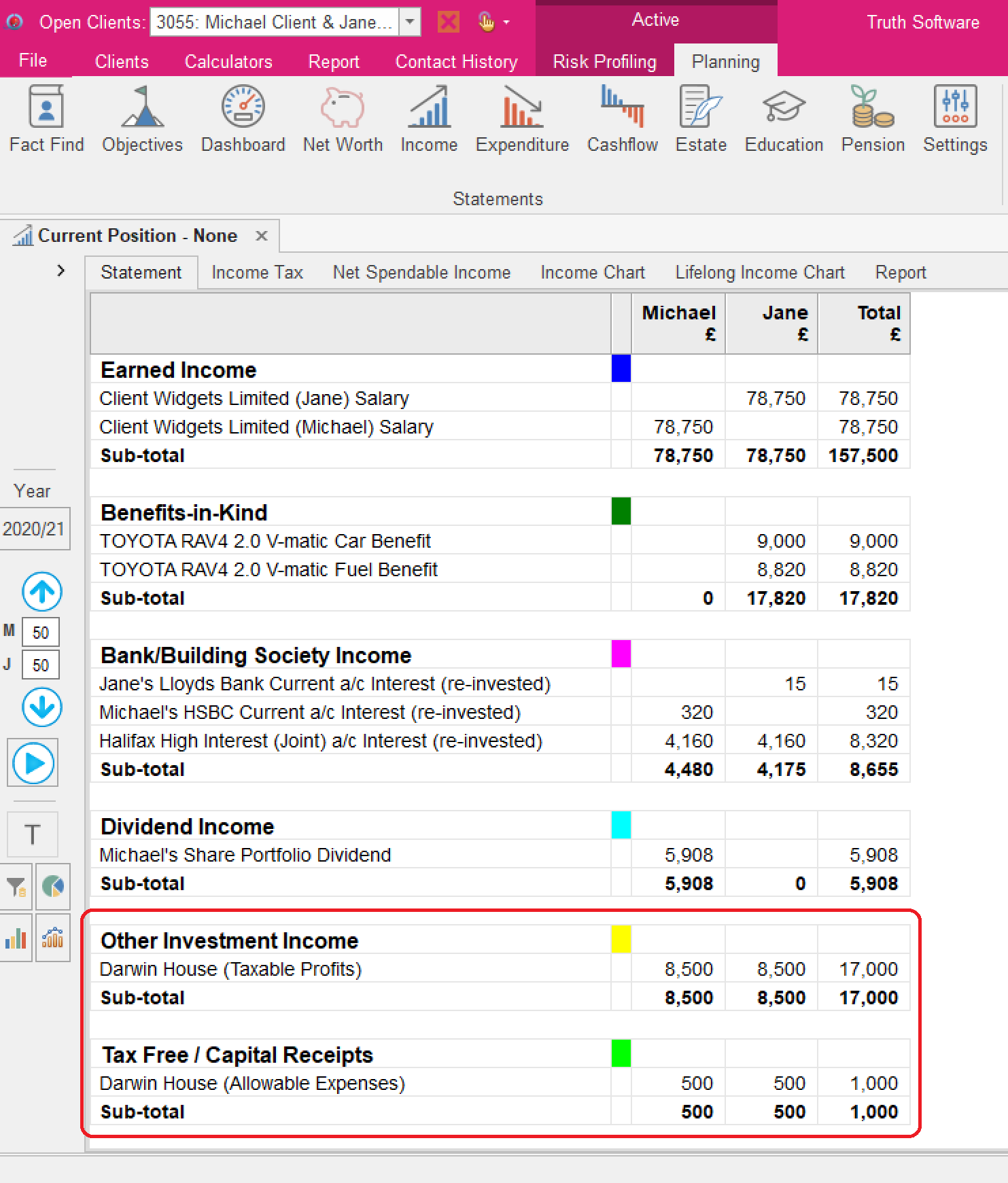

The taxable profits and allowable expenses now appear on the Income Statement as shown here:-

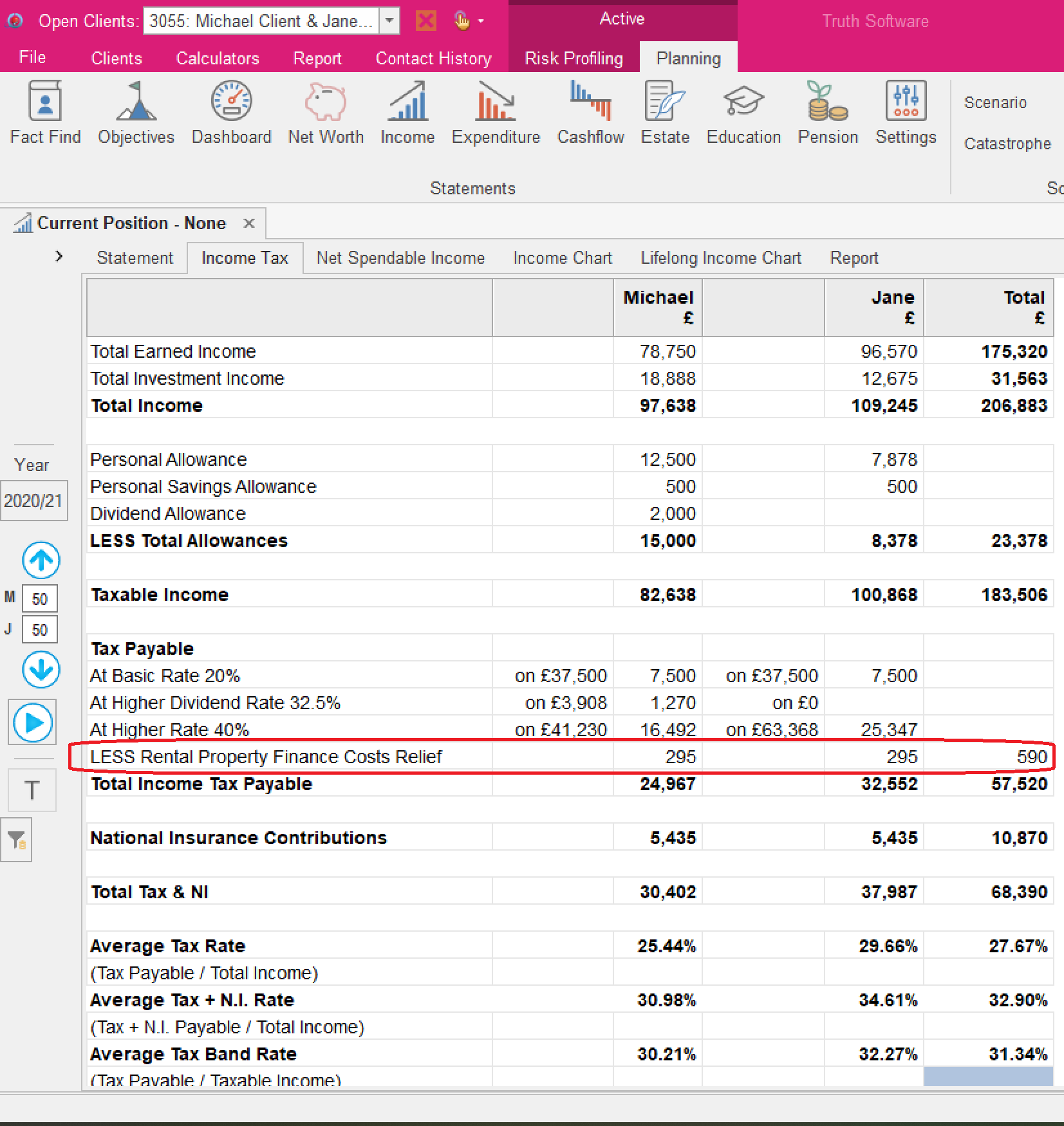

With any Finance Cost Relief deducted from the Income Tax calculation:

Changes to the Property item:

- On the Details tab, you can now select a linked mortgage. This will do two things:

- Calculate and apply any Finance Costs from the mortgage if it’s a rental property

- Automatically redeem an outstanding mortgage if the property is sold.

- Any Personal Expenses now show a combined total.

- A new table added on the Rent Received tab. Here we calculate and summarise any Rent Received, Allowable Expenses, Property Profits and Finance Costs. Allowable Expenses can be amended within the table for any projected spending difference. Double-clicking the Finance Costs will open the linked Mortgage item.