A client asks you to review their current life assurance arrangements, where do you start?

You have an up-to-date fact-find, so you could adopt a “rule-of-thumb” method, such as covering 10, 20, or even 25 times their annual expenditure. There are, however, a number of problems with such approaches.

Firstly, you aren’t accounting for the escalation of their expenditure. It’s fairly safe to assume that the majority of their costs will escalate at least in line with inflation; some costs might increase far more rapidly. Private school fees, for example, can escalate at up to twice the speed of inflation.

Secondly, you aren’t taking into account any ‘irregular’ expenses, which your clients might have planned for in the future. What would happen, for example, to the £20,000 they were planning on spending towards the cost of their daughter’s wedding (granted she’s only 8, but it pays to plan ahead)? How about the £80,000 they were intending to spend on improvements to their house?

If you’ve entered your client’s existing life cover into Truth®, all you need to do is look at the Lifelong Cashflow Chart and switch to viewing the catastrophe where your client (or their partner) had died yesterday. Based on all of the assumptions you’ve already entered, you can instantly see whether your client’s life cover prevents their beneficiaries from running out of money.

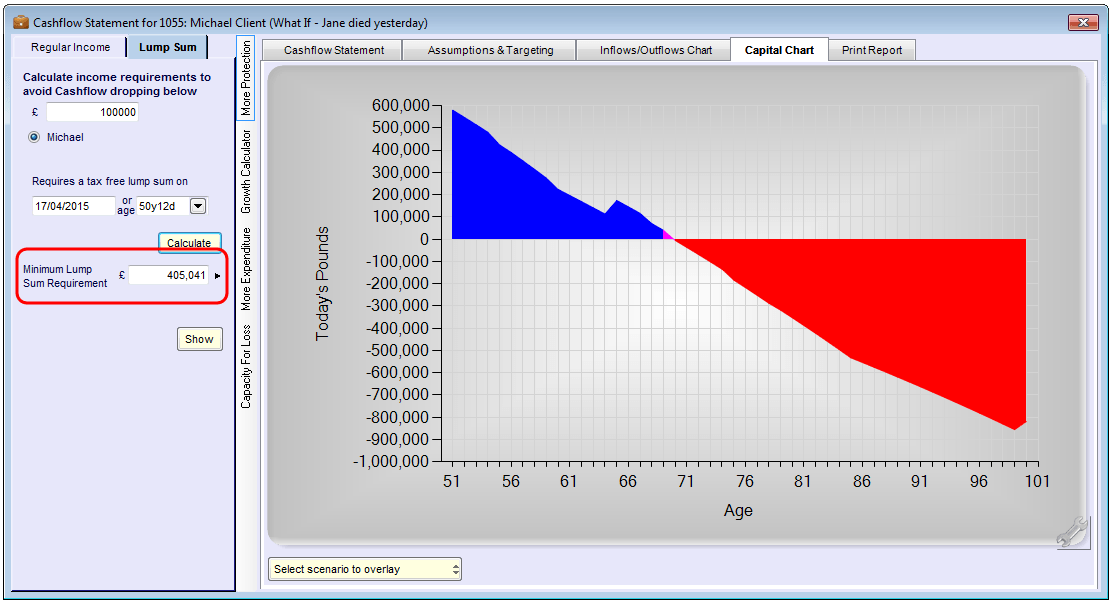

But what if they do run out of money? Clicking on the ‘More Protection’ tool will give you the option to calculate either a lump sum (i.e. a term assurance), or a regular income (i.e. family income benefit) for the survivor to prevent their capital reserves dropping below an agreed level. In the example below, I’ve calculated how much income Michael would need to prevent his liquid capital dropping below £100,000 in the event of Jane having died yesterday.

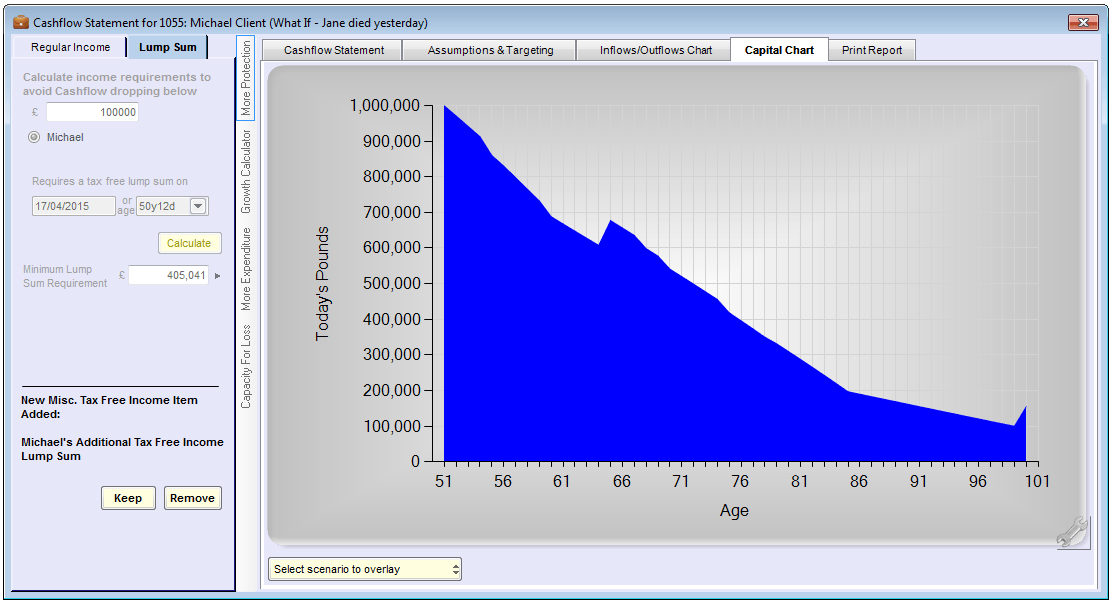

This figure comes out as £403,838. Clicking ‘Show’ will illustrate the effect of this additional cover:

This figure comes out as £403,838. Clicking ‘Show’ will illustrate the effect of this additional cover:

Jane has an existing term assurance policy for £100,000. Rather than pay two premiums, I’m going to recommend that she cancel her existing cover, and take out a single policy to cover the entire sum of £500,000.

By entering a new Term Assurance policy in a “What If” scenario, I can quickly demonstrate the suitability of the product I’m recommending. Not only will this show that the level of cover is exactly what the client needs, but also that the premium is affordable.

Now it’s time to get some quotes!