30 mins CPD

Learning Objectives:

- Considering the implications of key assumptions on cashflow models

- Understanding the impact of longevity on liquidity, pensions, and lifestyle

- Exploring and justifying what is “reasoned and reasonable”

In the second blog in this series, we look at the impact of life expectancy or longevity on cashflow models, including:

- For how long should you project?

- How should you deal with older clients?

- Managing clients expectations on mortality

Expert Insight

We’ll look at the wide-reaching implications of the assumption you make below. For now, here’s what some of our users had to say about life expectancy:

Life Expectancy

Why is it important?

How long should you project your cashflow models? Should you assume the same for all clients?

Some clients have preconceptions about their own expected mortality – whether it’s the age their parents lived to, their own feelings, or an “average” life expectancy figure. Some clients have no idea and rely on your experience.

While it’s vital that assumptions are agreed upon by both client and adviser, the adviser can help steer the client towards what’s sensible. After all, what if your clients aren’t average? By definition, an “average” life expectancy is a number that’s too high for 50% of clients; too low for the other 50%. Both projecting too long and too short a cashflow carry risks.

The risk of running out

Projecting a client’s cashflow beyond their life expectancy sounds like optimism, but is actually quite the opposite. It means we are erring on the side of caution and adopting a pessimistic attitude to things like:

- Pension withdrawals – will necessarily be lower if they need to be sustained for an additional 16 years

- Care costs – assuming “worst case” scenarios where a client might need care for an extended period, e.g. from age 75 to age 100

- Market crashes – adopting a strategy that is stress-tested and sustainable even if clients outlive the average

- Overall liquidity – ensuring that we can ensure clients have no liquidity problems even if they survive 16 years beyond their expected mortality

To put this into context: a 60-year-old client with a £1,000,000 pension pot growing at 4% could expect an annual income of £57,200 over 20 years. If the same pension fund had to last 30 years, they would have to settle for £40,800 per annum. Over 40 years, just 32,700 (or a 43% reduction in starting income).

If we plan for average life expectancy but live beyond this, funds will obviously be depleted. Should we, therefore, always project beyond average life expectancy and adopt a more conservative withdrawal strategy?

While it might be prudent to “overshoot”, showing clients how their cashflow might look were they to live to 90, 100, or even higher, bear in mind that they are statistically unlikely to reach these ages. The reassurance these extra years of projection provide need to be weighed against the very real prospect that they will die before the end of their cashflow.

The risk of dying with too much…

Remember, it’s not just a question of sustainability and caution. As well as the obvious risk of running out of capital before you run out of the need for capital, there’s a very real risk of clients dying with too much money. You could argue that the risk of dying without having done the things you always dreamed of while you had the chance is even worse than the risk of running out of money.

Given the choice, do you know ANY clients who would prefer to die with more money than they need, if it meant they didn’t do that world cruise when their partner was alive, didn’t see their grandchildren go through uni, never bought a 1978 VW Transporter and spend 3 months driving round the Algarve, or never realised their self-build dream?

Imagine, for a moment, that you’ve shown a 60-year-old couple their cashflow model. This robust and reliable plan illustrates that their pensions will last them through to age 100. They would be able to weather the storm of the most significant adverse market events of the last century. They can shoulder the costs of long-term care residential care without jeapordising their legacy.

Five years later, the markets have been kind. They find themselves sitting on an unexpectedly-large pile of money. They haven’t adjusted their spending, gifted more, or enjoyed their retirements as much as perhaps they could have. One of them has just received an unwelcome diagnosis…

This, more than any of the assumptions we’ll look at over this series, highlights the value of annual reviews. It is essential that we regularly re-assess a client’s cashflow and help them make financial decisions based on the latest and best information we have at our disposal.

What is reasonable?

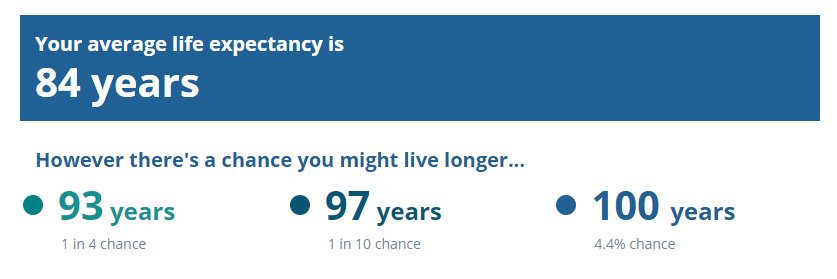

For a 50 year-old male, The ONS’s Life Expectancy calculator shows “average” life expectancy as 84 years, with just a 4.4% chance of reaching age 100:

Source: https://www.ons.gov.uk/peoplepopulationandcommunity/healthandsocialcare/healthandlifeexpectancies/articles/lifeexpectancycalculator/2019-06-07

Projecting to age 100 for a client whose “average” life expectancy is 84 might seem optimistic but, as we’ve seen, the opposite is true.

It’s worth considering the fact that “High Net Worth” clients tend to exist in a better-than-average socio-economic background. Primary Care Trust figures in 2011 indicated that you were 400% more likely to die of heart disease if you lived in one of the poorest suburbs of Manchester rather than in one of the richest boroughs of London1.

One assumption that several of our customers have mentioned is looking at ONS averages plus a number of years for healthy clients. E.g. using ONS + 5 yrs for the above client we might project to age 89.

If clients have already exceeded their average life expectancy, a very short projection could result in very uncomfortable conversations. In cases such as this, it is often worthwhile modelling to a greater age than you might typically and explaining this to your clients.

We’ve also heard of clients who are insistent about projecting far shorter. There could be relevant medical conditions to justify this, but it’s often on the premise that both sets of parents had passed on by e.g. age 90, so why should they expect to live significantly longer. Again, it’s worth considering the context of such cases. Socio-economic conditions may not be the same for them as they were for their parents or grandparents; medical science has definitely made numerous conditions more survivable over the past 30 years.

There is absolutely no harm in showing clients such as these a cashflow projecting up to age 100 which indicates they might run out of money in their 90s. You can show them contingencies, such as downsizing or equity release. By doing so, we can cater to their pessimistic view on their own mortality while also protecting ourselves. After all, you have no more certainty about being right than they have, but they will definitely hold you to account if you’re wrong!

In essence: the longer you project for a client, the more cautious your cashflow model is. Projecting their cashflow model beyond their average life expectancy effectively provides further stress-testing (“what if I live for an extra 16 years”).

It is wise to have a standard assumption for life expectancy. You should document what the assumption is and the reasoning behind it, but also to be prepared to be flexible. If clients are insistent that they want their cashflow to run to 85 or 110, consider showing these as alternative models.

As with all things, it’s essential that the model is reviewed and revisited regularly.

Further reading

The following are useful resources when deciding on and documenting your assumptions and the reasoning behind them:

ONS Life Expectancy Calculator

Government Actuaries Department (GAD) Mortality Insights: Modelling Future Life Expectancy