The new FCA Consumer Duty rules are designed to deliver higher standards of consumer protection. While this is fantastic news for consumers, it makes me wonder what FCA on-site inspections have unveiled over the years.

Consumer Duty is designed to ensure that firms provide:

- helpful customer support

- timely and clear information that people can understand

- products and services that are right for their customers

Reading between the lines, this suggests the FCA has identified firms who are providing UNhelpful support, UNclear information that clients CAN’T understand, and products and services that AREN’T right for their customers.

What does it say about our profession that we require regulatory intervention to ensure clients are getting what should be seen as basic acceptable standards of service? Surely, these aren’t things that we should need legislation to enforce.

Making the invisible transparent

Predictions from the FCA that the new rules will lead to a “major shift” in financial services indicate just how varied the standards of transparency and customer focus are across Financial Services, and how far we must go to improve the reputation of financial advice in the eyes of the general public.

Remember that financial services are just that: services. Unlike the primary and secondary sectors of the economy, the service sector provides intangible “goods” to consumers in the form of advice. While financial planning firms also serve as product vendors, the non-regulated business of “Financial Planning” itself is something clients can’t see. Perhaps this is why some firms struggle to communicate the value of their client proposition?

Clients can see their pension application. They can see their life assurance documentation. They have paperwork (or pdfs) and that paperwork has standards and requirements. They have acronyms to protect them, from KFDs to TCF. But when it comes to “advice”, they have something intangible and invisible. They can’t hold it or see it or take it home with them, so how are they meant to understand what they’re paying for? How do we increase the standards of transparency for something that’s already invisible?

An unsustainable “product”

When it comes to justifying client fees, many firms fall back on investment returns. By delivering something tangible, quantifiable, and measurable to clients, we effectively make returns our product. In some ways, this is easier than trying to explain the value of our service. But it’s also lazy and unsustainable.

In “selling” clients market-beating performance as a product, we’re deflecting from the question of “what value are you delivering for my fees” and instead relying on something which is unpredictable and beyond our control.

A recent Which article gives the average cost of ongoing financial advice as 1.9% p.a. (after factoring in product and portfolio charges). What happens when markets inevitably tumble and your client’s portfolio grows by less than the cost of your fees? They’re still paying you, but not receiving the “product” they paid for. Until they STOP paying you!

The symptom and the disease

If reliance on investment returns as evidence of value is the disease, AUM (or AUI, or AUA) figures cited as a measure of business success is the symptom. Clambering after clients who have large portfolios will inevitably leave you chasing your own tail in trying to evidence the value of your proposition.

Imagine, for a moment, you have a client with £10m to invest. You intend to charge 1%. Where can you add £100,000 worth of value for this client? If YOU can’t see it, odds are that the client won’t be able to, either!

What if the same £10m were split across 20 clients, each with £500k investible assets? You still charge 1%. To achieve the same £100k revenue, you have to do 20x the work (or more). While you might have an easier job proving to your client that your time and efforts and those of your staff and colleagues are worth £5,000 to them, are you charging enough for that time?

Without getting too deeply into a debate about charging structures, it’s clear that there is a problem. Of course, the solution is fewer, more profitable clients! But, while we can all strive toward the perfect business model, a good place to start would be an alternative and more sustainable metric by which to measure success.

What do clients REALLY value?

So, what if we could find a reliable way to substantiate the value of financial advice without reliance on investment returns? What if we could provide clients with a transparent indication of the value of the service they’re paying us for, rather than trying to pass that service off as a product?

The starting point for this process needs to be a fundamental shift in focus. Rather than looking at things from the adviser or advice firm’s perspective, we need to look at it from the point of view of the client. What is the client looking for from the adviser relationship? Where might the client perceive value in that relationship? What aspects of that relationship couldn’t be replicated by the clients themselves, another adviser, or a robo-adviser?

If you sat down in a room with a thousand happy clients and asked them “what do you value most about your financial adviser?”, how many of them do you think would give an answer that mentions investment returns?

What clients value, and I’m telling you this from our experience of nearly forty years speaking with tens of thousands of advisers who have serviced millions of happy clients, is comfort, reassurance, and clarity. They come to you with a problem or fear, they come away with a solution and with confidence. Sure, some of this confidence has resulted from pound signs and zeroes being added to their portfolios, but that’s not what they remember.

When clients judge your performance in terms of the investment returns you are able to deliver for them, there is a perpetual need to continue delivering these returns. When the focus shifts instead to helping them realise and achieve lifestyle goals, the tail chasing can finally end.

Quantifying “confidence”

The “problem” with this client-centric approach is that the value of a client’s portfolio is much easier to quantify than understanding and happiness! When we move away from a tangible product toward a service, how do we collate data on this non-product?

One approach we’ve seen applied with incredible success is customer satisfaction surveys. Quite simply, you ask a client how happy they are with various aspects of their financial situation before your meeting, using measurable indicators. After your meeting, you ask the same questions again. Any improvement in these measures shows improvement in confidence.

There are many ways of achieving this. Whether you give clients a physical questionnaire, a digital form, or use an app (like ScoreMy). By keeping track of these scores over the course of a series of meetings, you have a means of putting a number to an otherwise abstract service and demonstrating clear added value. All without ever selling a product or looking at a fund performance chart.

Don’t be lazy (focus on the results)

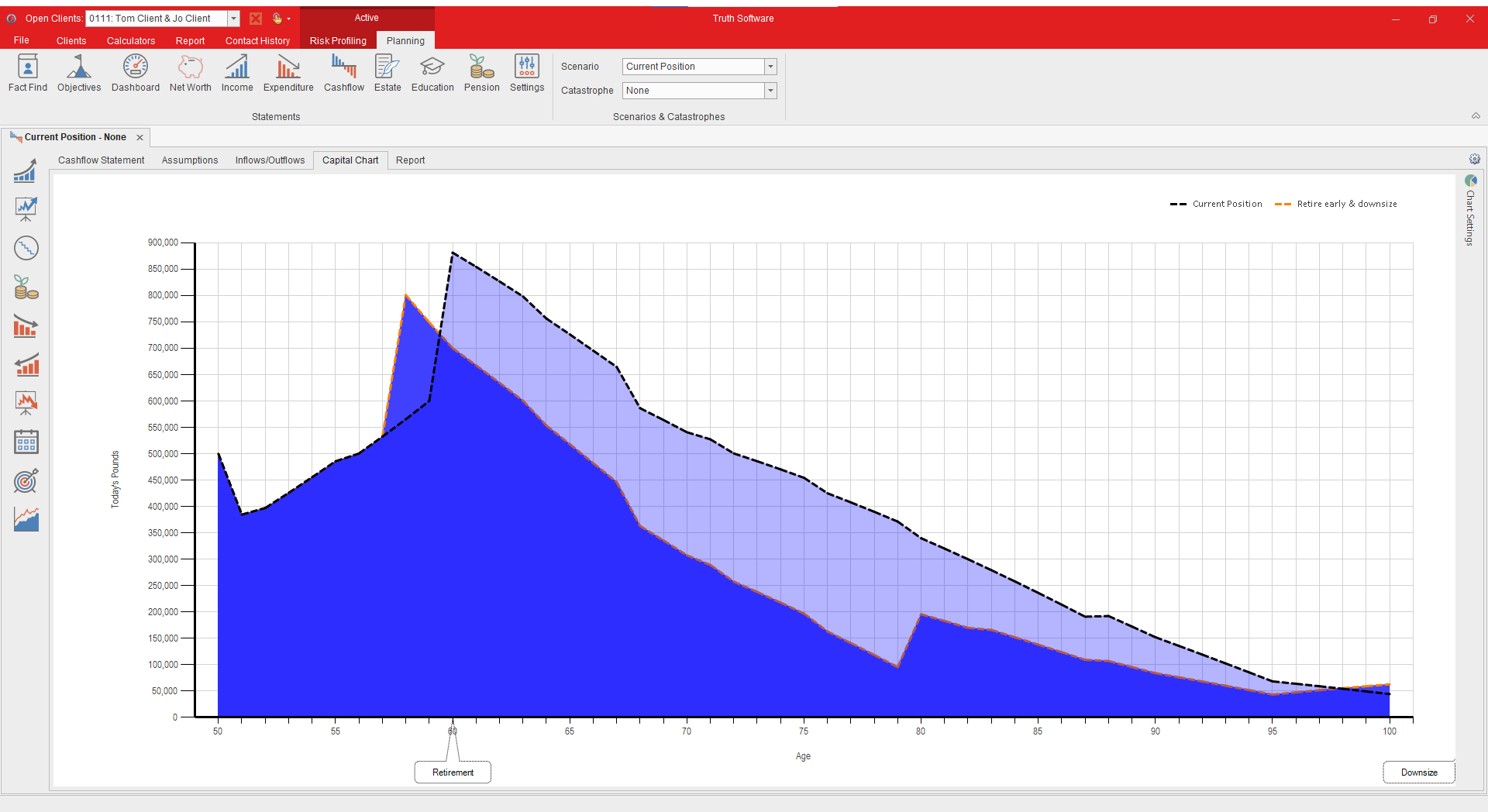

For firms who have long embraced lifelong cashflow modelling, Consumer Duty will not result in the “fundamental shift” in processes that the FCA predicts. When clients can already understand the advice they receive and clearly see its value, no change is necessary.

But before you say “Adam, of course you would say cashflow modelling is the solution, you sell cashflow modelling software!”, cashflow modelling is NOT the solution. Don’t fall back into the trap of deflecting and “selling” cashflow modelling as just another product. It’s not the tool itself, but rather the shift in mindset that cashflow modelling helps deliver that’s the answer. Try not to focus on the service you’re providing, but instead on the results that it facilitates for your clients. Take the blinkers off and try to see things from the client’s perspective.

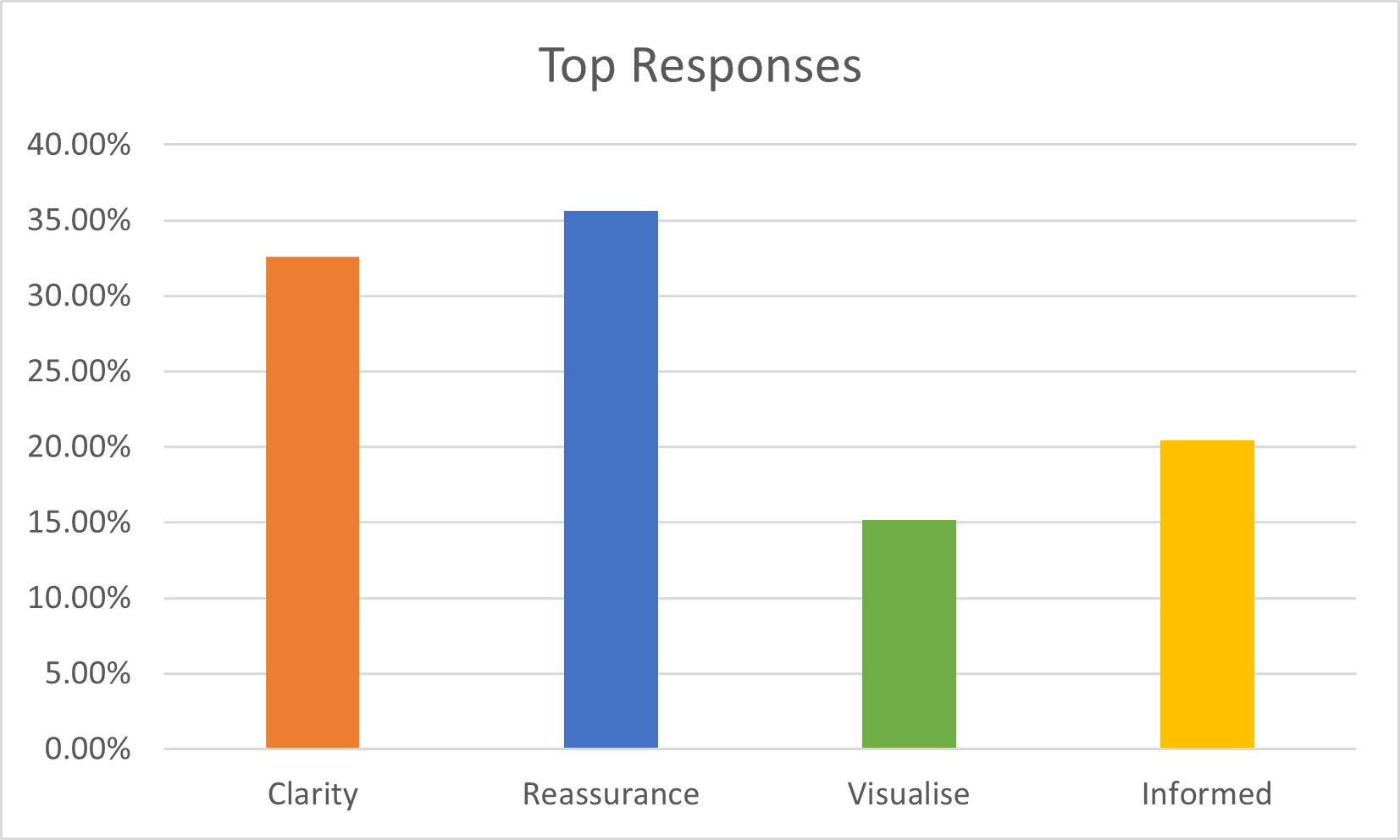

We’ve done a little research into what clients value from the advice process. In a recent survey (you can still contribute your thoughts here), we asked advisers what their clients value about cashflow modelling. 21% talk about clients becoming better informed and more engaged with the planning process; 36% of responses mention increased confidence or reassurance; 33% mention clients find cashflow modelling gives them clarity or an improved understanding of their financial situation. And remember, consumer understanding is one of the key areas of focus under the new Consumer Duty regime.

There is no panacea or magic pill which will improve your profitability overnight. There is no switch you can flip which will improve client retention. But adopting a truly client-centric approach to financial planning (maybe even facilitated by cashflow modelling software?) and seeing things from a client’s perspective will help you understand the value that your service actually delivers to your clients. Would you pay for what you’re offering? Would you understand it? Would you judge it to be good value for money? If you can honestly answer “yes” to these questions, then so will your clients.