Cashflow Modelling to form part of APTA…

The FCA consultation document on replacing the TVA with APTA (Appropriate Pension Transfer Analysis) has suggested that Cashflow Modelling software could help consumers understand the complexities of DB transfers. But they’ve also expressed concerns about consumers’ ability to understand the outcomes of stochastic modelling. So how can Cashflow Modelling help you, as an adviser, deliver the best possible outcomes for your clients?

Since 1984, we’ve offered a largely deterministic cashflow modelling tool to UK planners. We think it’s transparent, and helps clients answer key questions about the important financial decisions in their lives. We have a stochastic calculator within our software, which will allow you to calculate the probability of achieving a goal either in accumulation or decumulation, but in our eyes stochastic modelling isn’t (and shouldn’t be) the be-all and end-all.

This will be the first of a 2-parter, because there’s more to say here than most people can be bothered to read!

Part 1 will look at the role of cashflow modelling in DB transfer advice, and the kinds of modelling available. Part 2 (next week) will look at some of the intricacies of DB transfer advice, such as comparing risk exposure and catastrophe situations pre and post transfer.

So let’s get started on the kinds of modelling available…

Starter for 10 – what on earth are Stochastic and Deterministic Modelling?

I suppose I can’t begin without explaining what they are!

For those who are uncertain of the difference, here it is in a nutshell:

- Deterministic modelling assumes there is no randomness.

- Stochastic modelling allows for randomness (within limits).

In other words, in a deterministic model you control all of the variables (such as inflation, growth, expenditure…). In a stochastic model, we allow probability to decide what the value of one of the variables will be: in this case – investment growth.

Here’s one I made earlier

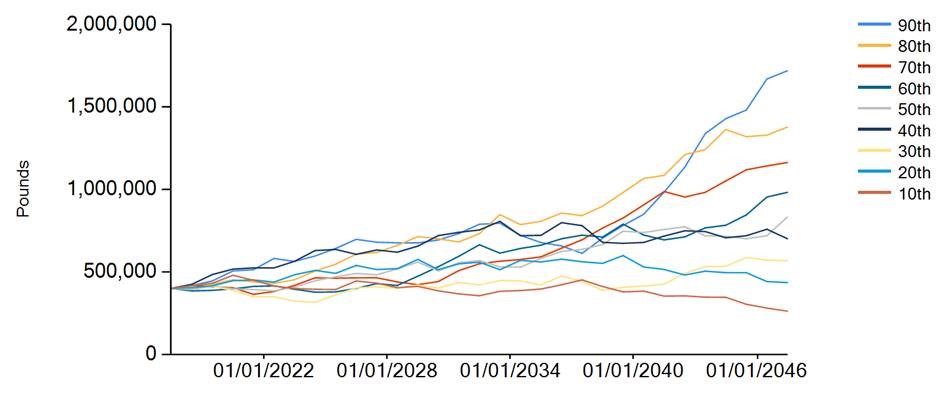

(Based on £400,000 invested in OMW Balanced Life fund, with 4% (£16,000/annum) annual withdrawals taken in arrears escalating at 2% per annum over 30 years)

I asked our stochastic calculator if a client could achieve 4% withdrawals from their £400,000 pension pot for 30 years. And fantastic news: it said YES! There’s a 96.24 chance of success. Great. But what does that mean, and is 4% enough?

In terms of what it means – we ran 10,000 simulations, based on the average growth and volatility of their portfolio, and in 96% of cases they had at least £100k remaining after 30 years. There were only 376 out of 10,000 simulations where they were below their “comfort zone” after 30 years.

So what?

Good question!

A stochastic simulation helps prove to the client that, potentially, their advised DB transfer might be a good idea. While in their DB scheme, their income is guaranteed for life, but their transferred pension might be able to give a similar (or better) income, and there’s a 96% chance it will do so. This picture shows a 96.24% chance of “success”… but it hasn’t shown whether it’s enough for the client to enjoy their desired retirement lifestyle.

Is 4% enough? What if they wanted to take ad-hoc withdrawals? What if their daughter is getting married in a couple of years, and they intend to splash out on a lavish wedding? Or maybe they just fancy a once-in-a-lifetime holiday, after 40 years in the world of work?

The advantage of a comprehensive lifelong cashflow model is that it takes into account all of the client’s lifestyle goals and objectives. Even the silly ones.

Why deterministic is clearer

In brief, because (as we established at the start) there’s no randomness.

Nobody is going to pretend that the client’s pension is going to grow at precisely 6.3% for the next 30 years, but it’s fair to say that that’s the fund manager’s goal. The advantage of assuming that there’s one specific growth rate is that we can perform a direct and straightforward comparison between two scenarios.

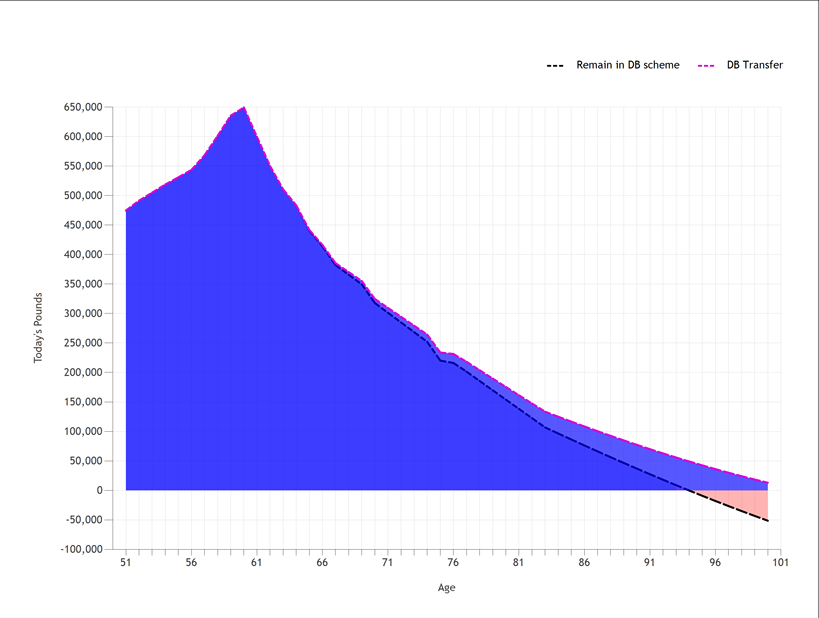

Here’s the same client’s deterministic cashflow model in Truth®. Our capital chart shows a client’s liquid capital, and how this changes over their lifetime. It allows you to see whether, based on their current plans, your client has enough money to live their desired lifestyle.

As the old saying goes: a picture paints a thousand words.

As the old saying goes: a picture paints a thousand words.

This chart speaks for itself, and is simple for consumers to understand. If they remain in the DB scheme, they don’t quite have enough money to realise their goals. If they take an escalating income from their transferred pot (at the intermediate rate of return), they do.

We need to know more…

This information on its own isn’t enough. The stochastic model says we have a 96% chance of being able to continue withdrawals for 30 years. Great. The deterministic model shows we’re better off in an unsecured pension than our current DB scheme. But we need to know more.

The big questions we need to ask are the “what-ifs” – what if the client were to die prematurely? What if they were disabled? What if there were a catastrophic market fall on the day before they took benefits from their uncrystalised fund?

That’s why clients need to come back year after year – to ensure that they remain on track.

And, thankfully, these are questions for another day![/vc_column_text][/vc_column][/vc_row]