Truth Software Release Notes 2018

Details of changes to our back office and Cashflow Modelling software

Maintenance update (01/10/2018)

General maintenance update and bug fixes.

For our Professional users, we’ve made an amendment to the RMA-J return in Gabriel to incorporate CP 18/11 changes:

“Firms should no longer report income for pure protection contracts in FSCS life distribution & pensions class. Pure protection income should be reported in the General insurance distribution class (SB02) for the firm’s financial year ending in 2018”.

Revenue from Pure Protection contracts will now automatically be displayed under SB02 for FSCS reporting purposes in RMA-J.

Pension Planning Update (Phase II) (16/07/2018)

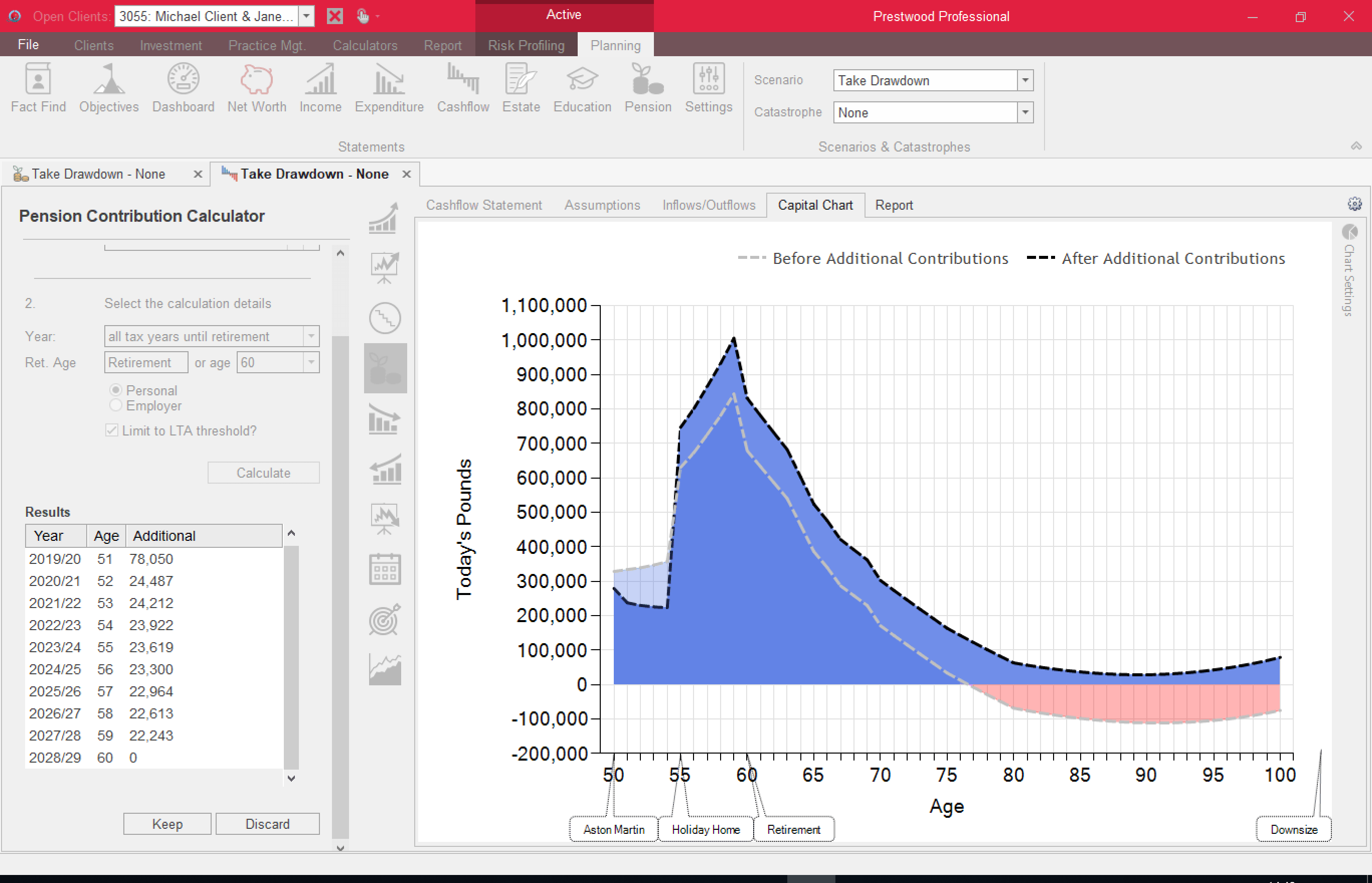

Pension Contribution Calculator – New Cashflow Tool

You can now demonstrate the impact of additional pension contributions directly from the Cashflow Statement, using our new Pension Contribution Calculator. It takes into account everything we recently introduced in phase one of our suite of Pension Planning tools and improvements.

In the example below, we have asked the calculator to work out maximum additional personal contributions for each year up to retirement, without breaching the Annual Allowance (AA) or the projected Lifetime Allowance (LTA).

The chart shows the client’s cashflow forecast before and after the additional contributions. You can choose whether to keep or discard the calculated contributions as a planning decision.

This new tool allows you to:

- Select an existing or new pension item to receive contributions.

- Select the contribution period

- Just the current tax year

- All years from now until retirement (or a selected age)

- Custom dates (simply tick which years to include).

- Personal or Employer contributions

- Whether to allow an LTA breach or not.

- Keep (payment history lines will be added to the selected pension item) or discard the calculated payments.

Pension Planning Update (Phase I) (20/06/2018)

As the first stage of our Pension Update, we’re pleased to announce your all-new Pension Statement; Lifetime Allowance charging, and Dynamic Sustainable Drawdown Income. More updates will follow shortly…

New Pension Statement

Featuring three distinct sections to help you answer key questions your clients may have each tax year, and new Lifelong Charts to help spot opportunities or potential problems in advance.

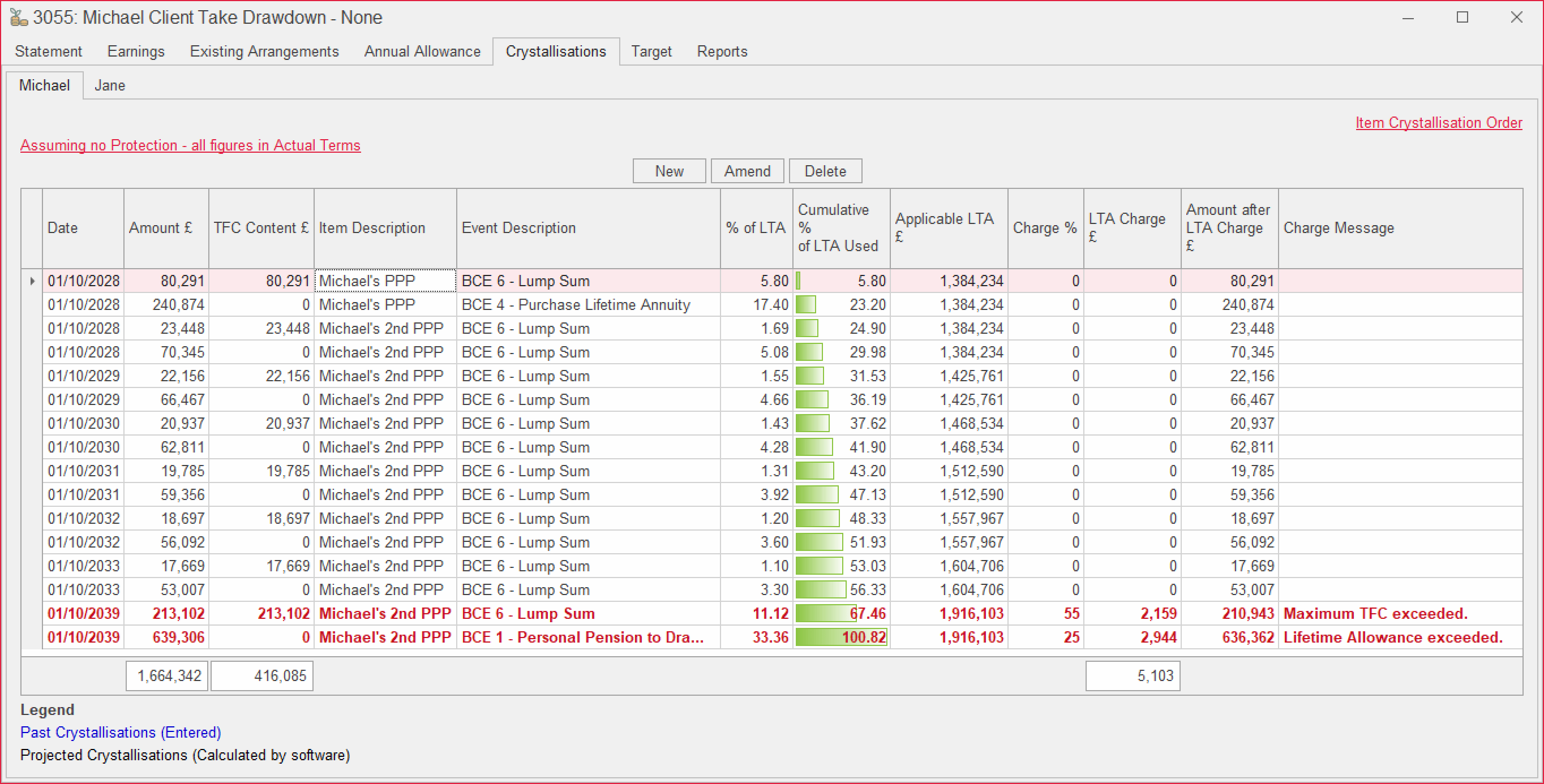

Lifetime Allowance Charging

The Crystallisations tab now shows you if there’s been a LTA charge, at what rate, and the net value of benefits after the charge. Pension benefits will appear net of LTA charge on the Income Statement and Cashflow, so you can easily show clients the true effect of different pension planning options.

Dynamic Sustainable Income Calculator

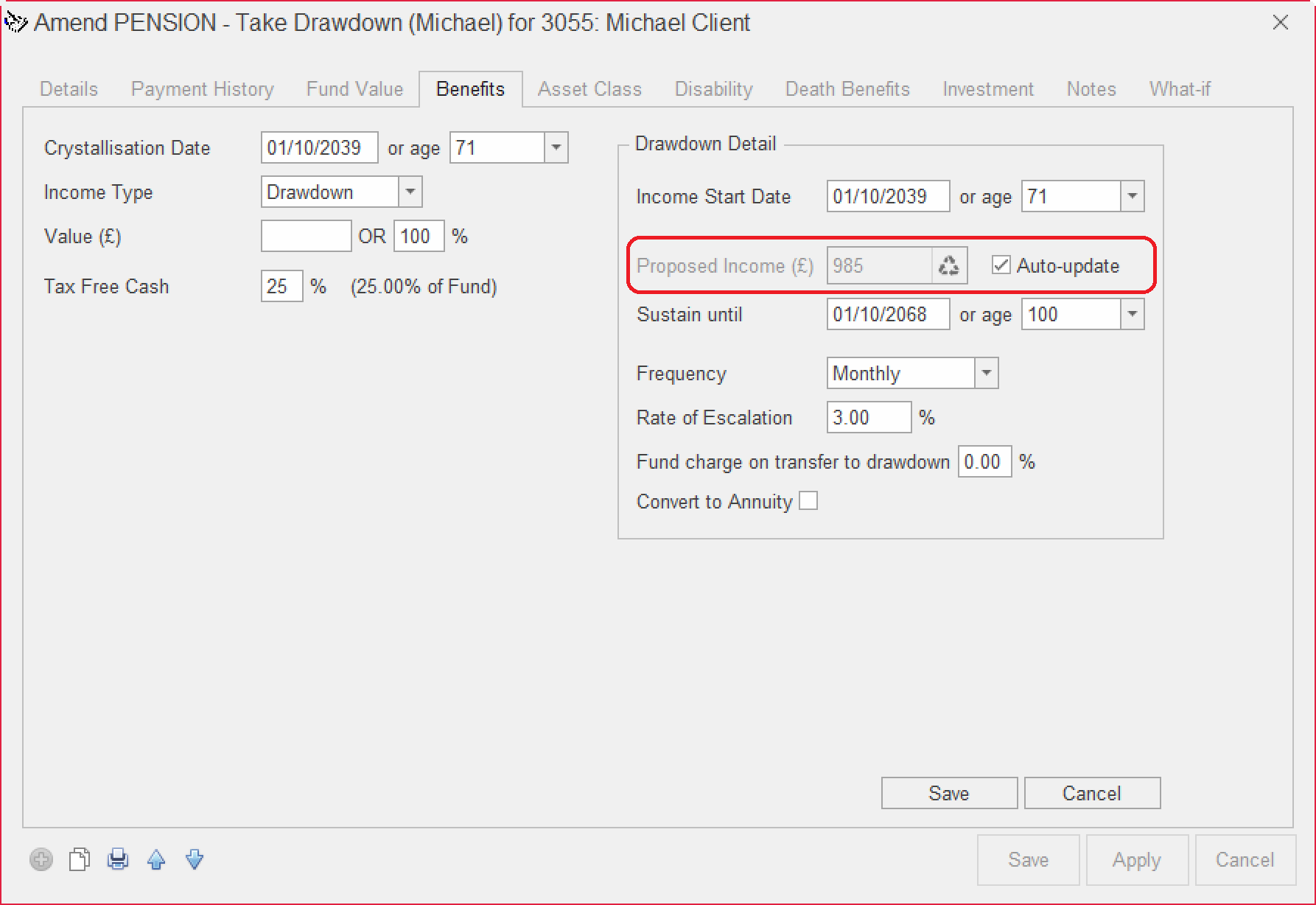

Dynamic Sustainable Income Calculator

We’ve had great feedback on the Sustainable Drawdown Income Calculator, which helps you calculate a sustainable income to deplete the fund. However, other assumptions which could impact on the fund value changed, that calculated income would remain the same until you elected to recalculate.

You now have an option to ‘Auto-update’ drawdown income. Should any assumptions change, Truth will automatically recalculate the new sustainable income amount for you.

Encrypted Exports, Income Improvements, & Aegon Wrap Link (08/05/2018)

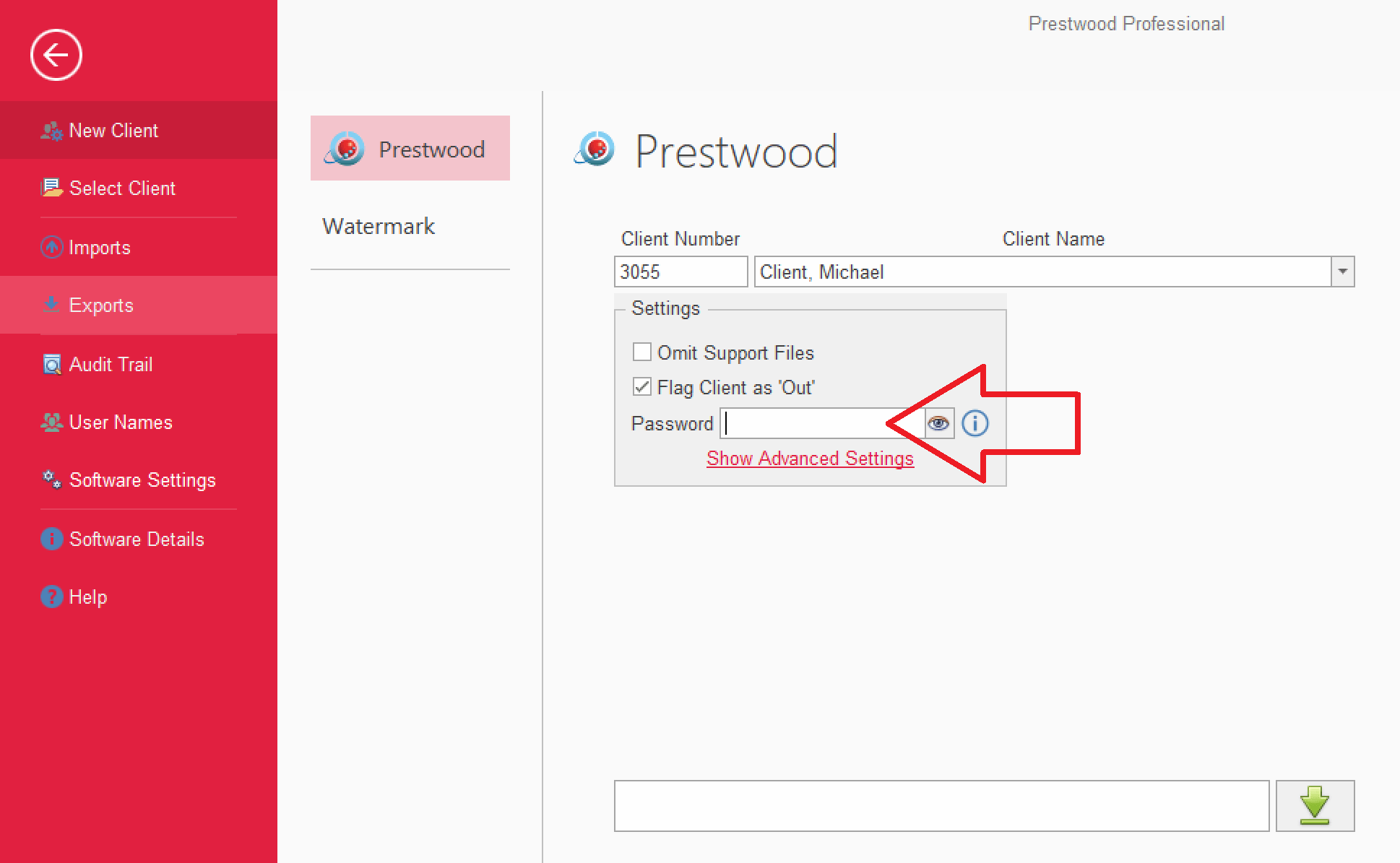

Exported client files are now encrypted

If client files are exported from now on, they will have full AES encryption for peace of mind and to aid you with GDPR. Furthermore, you can elect to export a client file and password protect it. Without the file password, no-one (including Prestwood people) will be able to read or import the file.

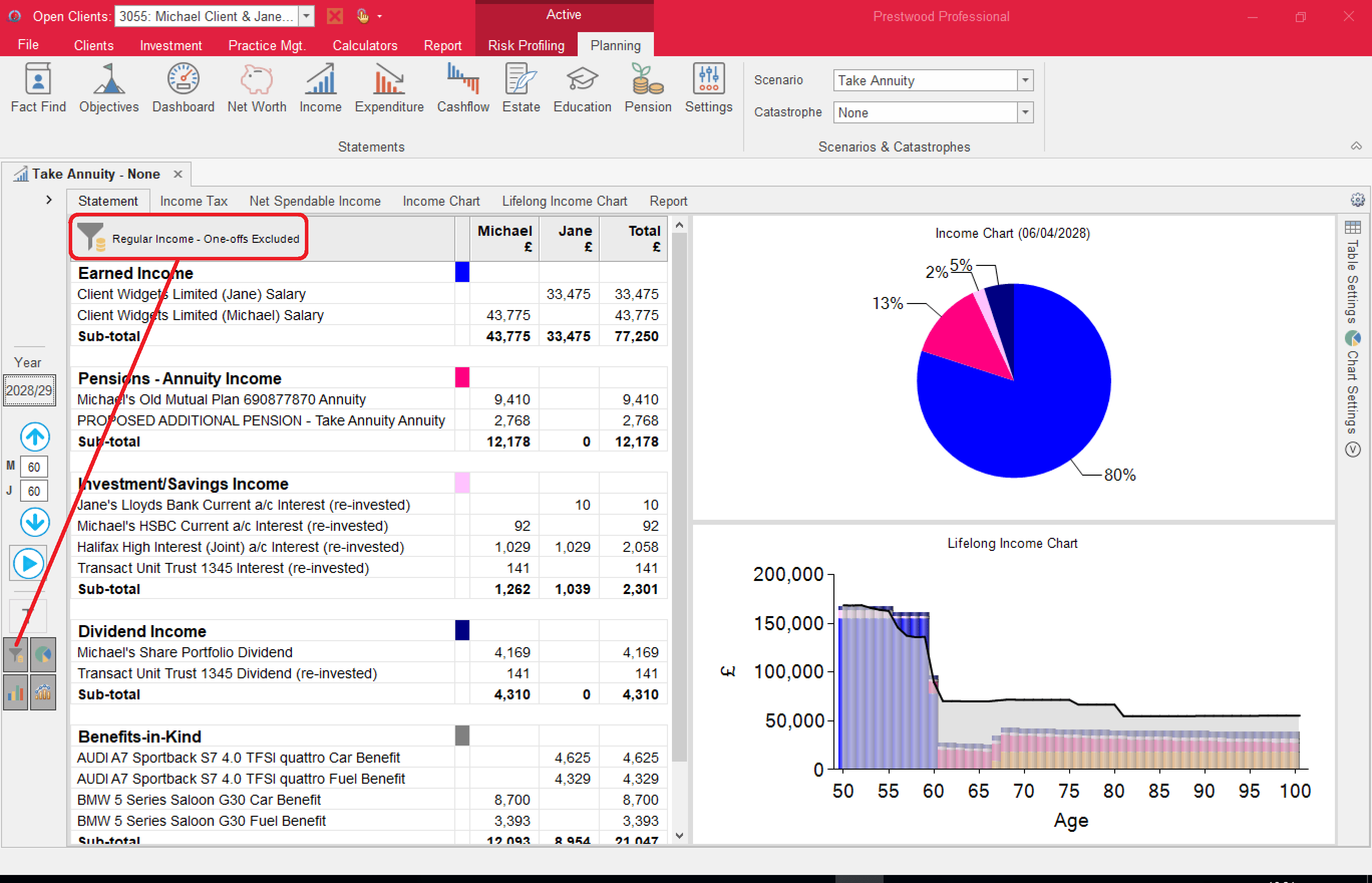

Improvements to Income/Expenditure Filtering

We’ve made it more obvious to show when you have filtered out one-offs from the income and expenditure statements. Filtering out one-offs is there to allow you examine regular ongoing income/expenditure to get a good feel for your clients’ lifestyle. When the filter is on the filter button will darken, as always. However, we now specify it in the column heading too as shown below.

Cofunds/Aegon

Cofunds have upgraded their customers to the Aegon platform. This update seamlessly handles the migrations for our mutual customers to continue to import the latest valuations for any relevant client holdings.

Budget Update (06/04/2018)

Tax Rates and Allowances

- Income Tax rates and Allowances, National Insurance rates, and Personal Allowances have been adjusted.

- The reduction in the Dividend Allowance (£5,000 to £2,000) will apply automatically from 06/04/2018.

- CPI indexation of the Lifetime Allowance (£1,000,000 to £1,030,000).

- The Main Residence Nil Rate Band will increase from £100,000 to £125,000 for those leaving Main Residences to direct descendants (for those with estates under £2,000,000).

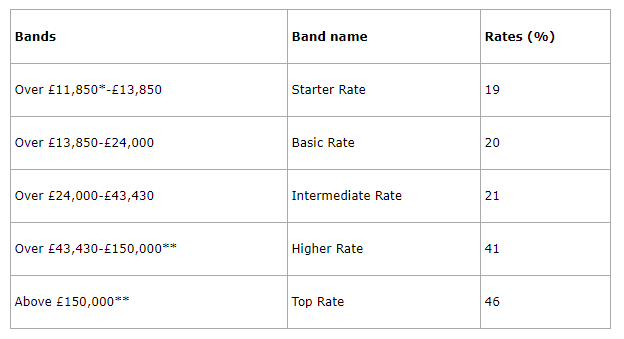

Scottish Rates of Income Tax (SRIT)

From 06/04/2018 SRIT will be charged at the following rates:

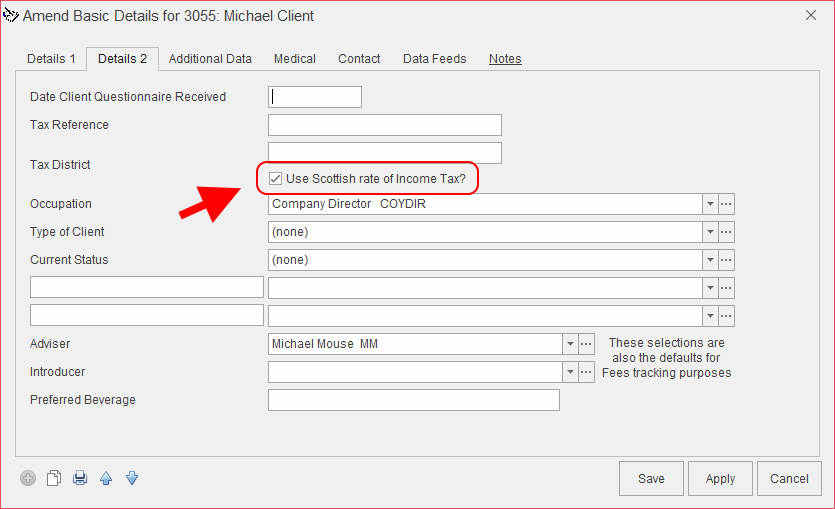

To apply SRIT for a client or partner, simply tick the “Use Scottish rate of Income Tax” option in their Personal Details:

To apply SRIT for a client or partner, simply tick the “Use Scottish rate of Income Tax” option in their Personal Details:

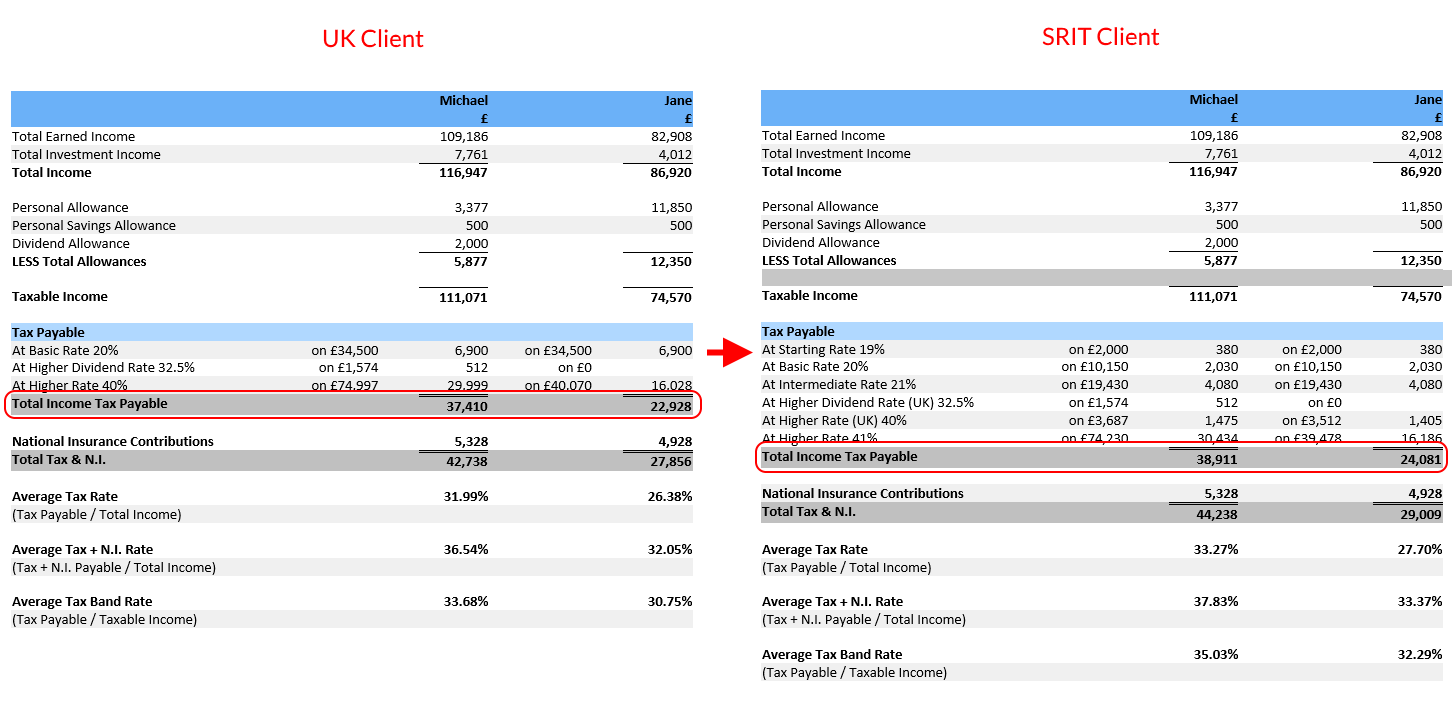

This will apply SRIT rates to any non-savings, non-dividend income, and UK rates to savings and dividend income, as illustrated below:

Sustainable Drawdown, Improved Client Meeting Experience, & Finametrica 3.0 (22/02/2018)

Sustainable Income Calculator

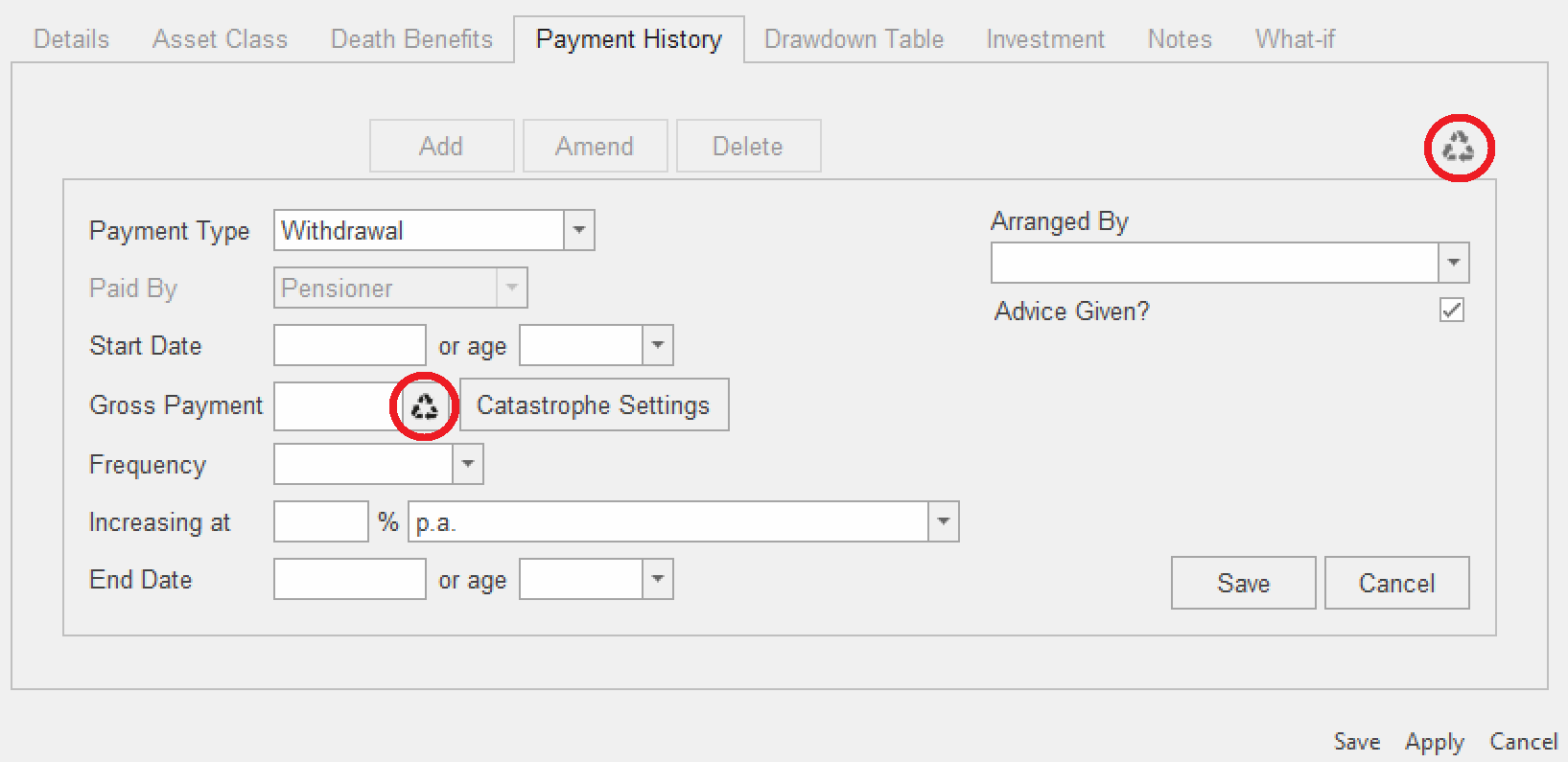

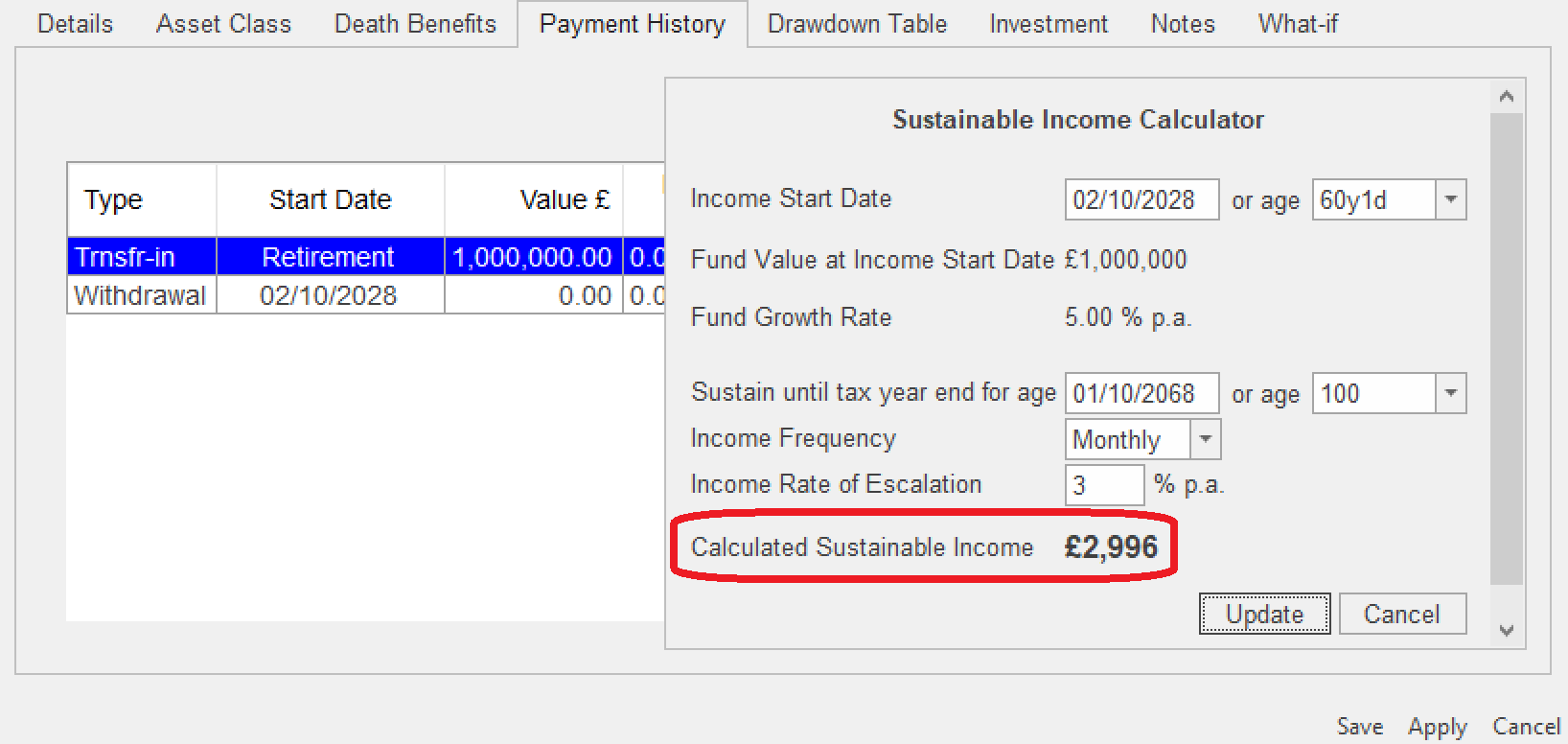

We’ve had great feedback about our Sustainable Income Calculator for DC Pensions – now you can access this in Drawdown Pension items too. Simply select the new tool from Payment History.

The calculator shows you what can be withdrawn, and allows you to adjust the assumptions there and then. No need to guess.

The calculator shows you what can be withdrawn, and allows you to adjust the assumptions there and then. No need to guess.

Fine Tune your Client Meeting Experience

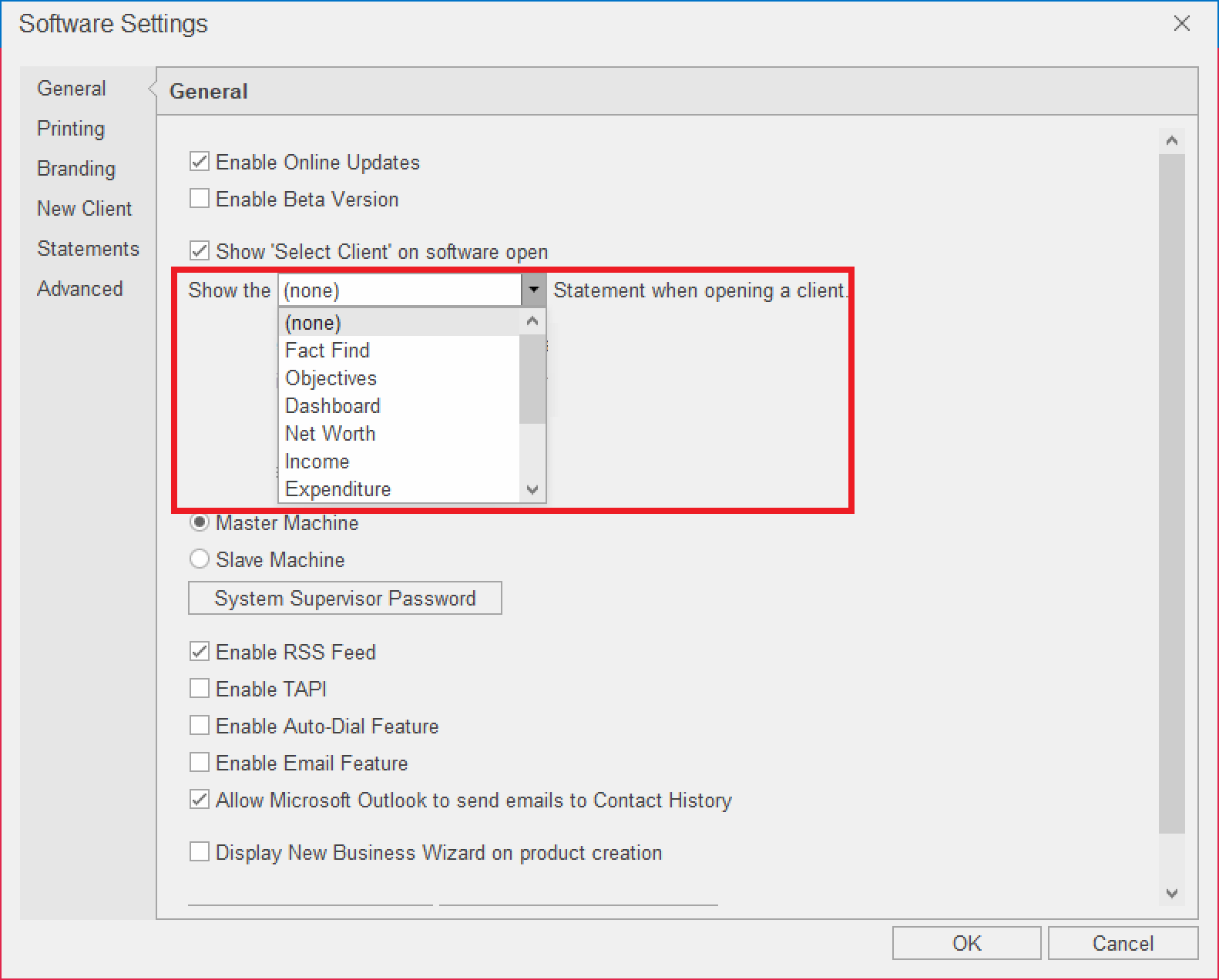

Choose what should be shown when opening a client

Your client meeting experience is priceless, and you should be in control of how it flows. Now when opening a client, rather than defaulting to Fact Find, you can choose which statement should be displayed first, if any. Display your branding, or go straight to the statement you feel is most appropriate. Choose ‘File’ and ‘Software Settings’ to make your selection:

Here you can see we’ve opened Michael & Jane Client, and decided not to open any planning statement, so we can emphasise our branding instead. Your logo can be placed here by going to the ‘Branding’ menu.

Here you can see we’ve opened Michael & Jane Client, and decided not to open any planning statement, so we can emphasise our branding instead. Your logo can be placed here by going to the ‘Branding’ menu.

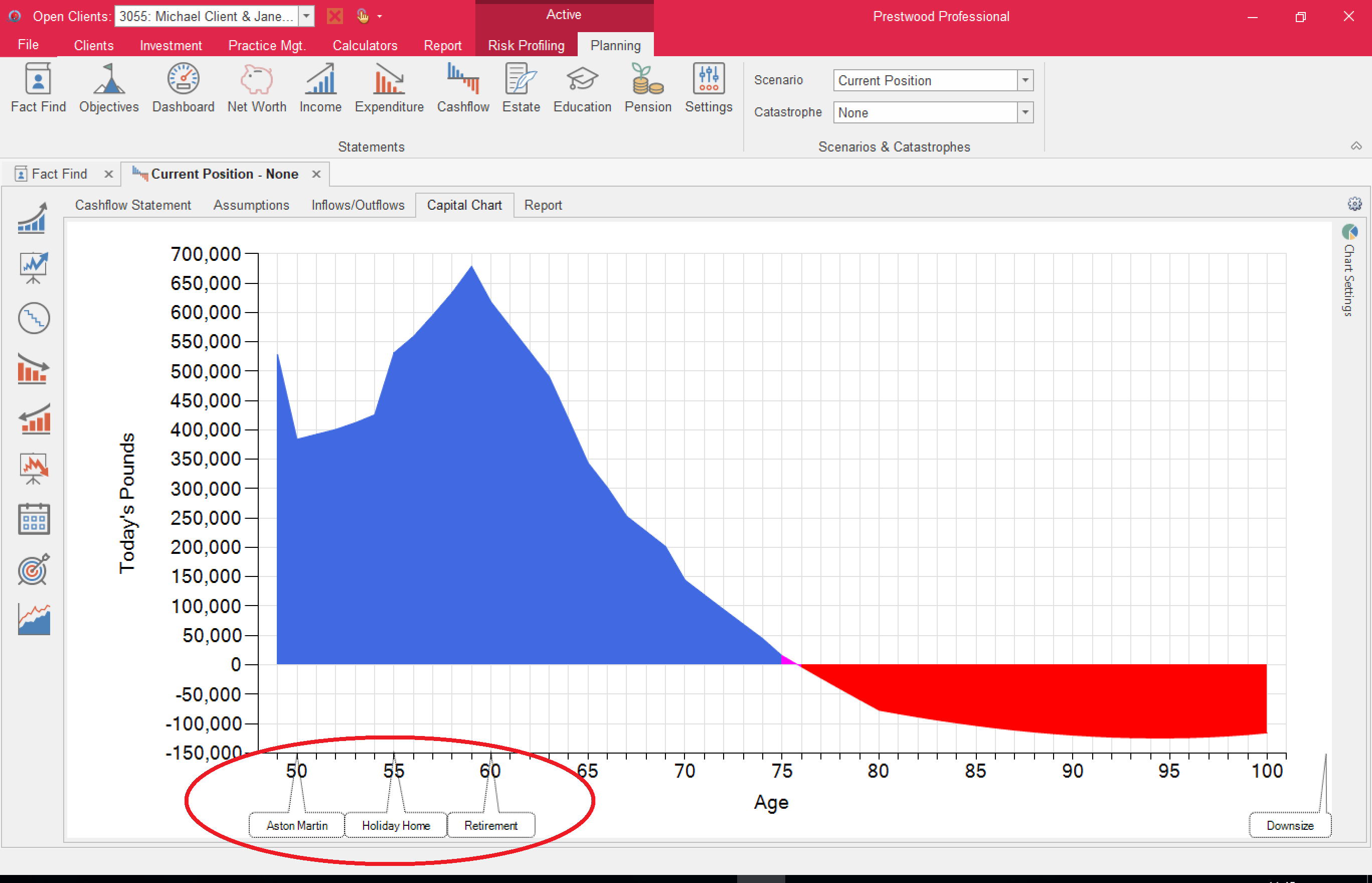

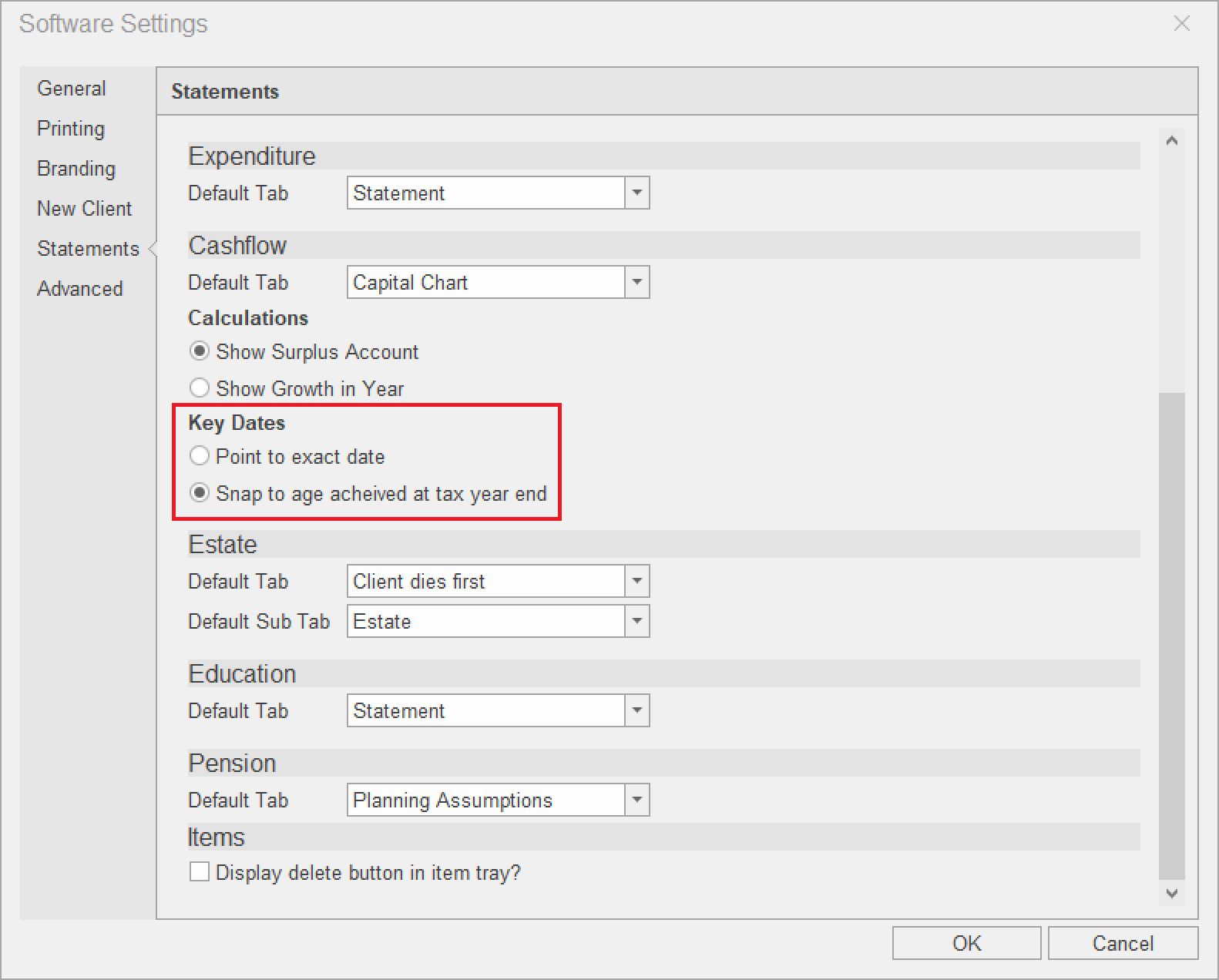

‘Snap’ Key Dates to Rounded Ages

Continuing with your client meeting experience, you can now choose to make Key Dates point to rounded ages on all lifelong charts. Previously if someone’s were retiring at 60, but their birthday were halfway through the tax year, the ‘Retirement’ key date would point halfway between ages 59 and 60, because we work in fiscal years and point to exact dates.

You can now force the Key Date to point to the rounded age achieved during the tax year, to make it easier for clients to understand. Don’t worry, we’ll still use the exact date for all calculations (you can double-click the Key Date slider to check)!

You can now force the Key Date to point to the rounded age achieved during the tax year, to make it easier for clients to understand. Don’t worry, we’ll still use the exact date for all calculations (you can double-click the Key Date slider to check)!

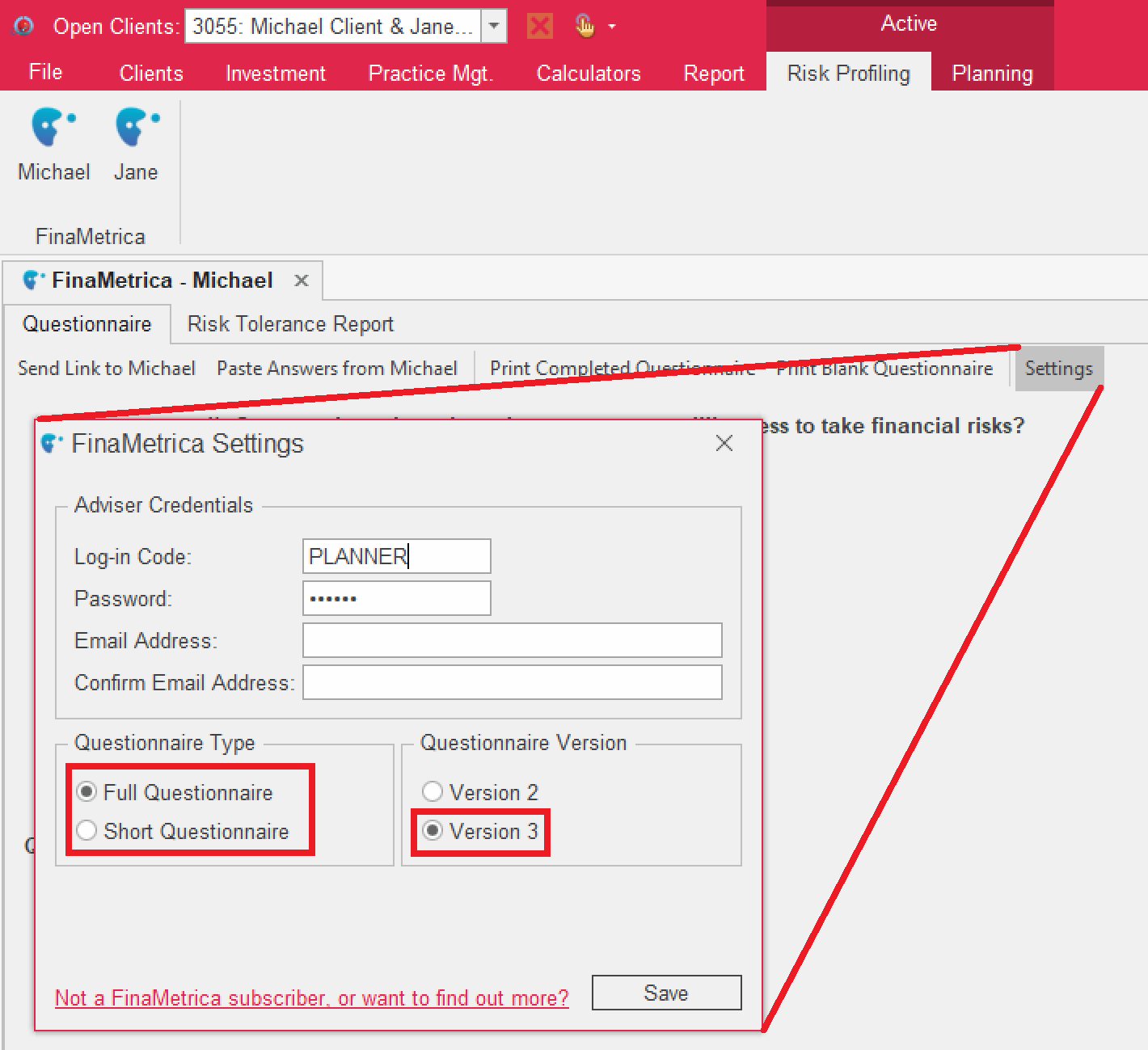

FinaMetrica 3.0

FinaMetrica have launched Version 3 of their risk profiling questionnaire, and you can now choose your preferred version from within Truth. The Full version is 25 questions and the Short version just 10. Version 2 will be discontinued at some point (25 and 12 questions) by FinaMetrica.

If you’re emailing links to our mirror site www.prestwood-software.com, only those questions for the version you selected will be seen by your client.

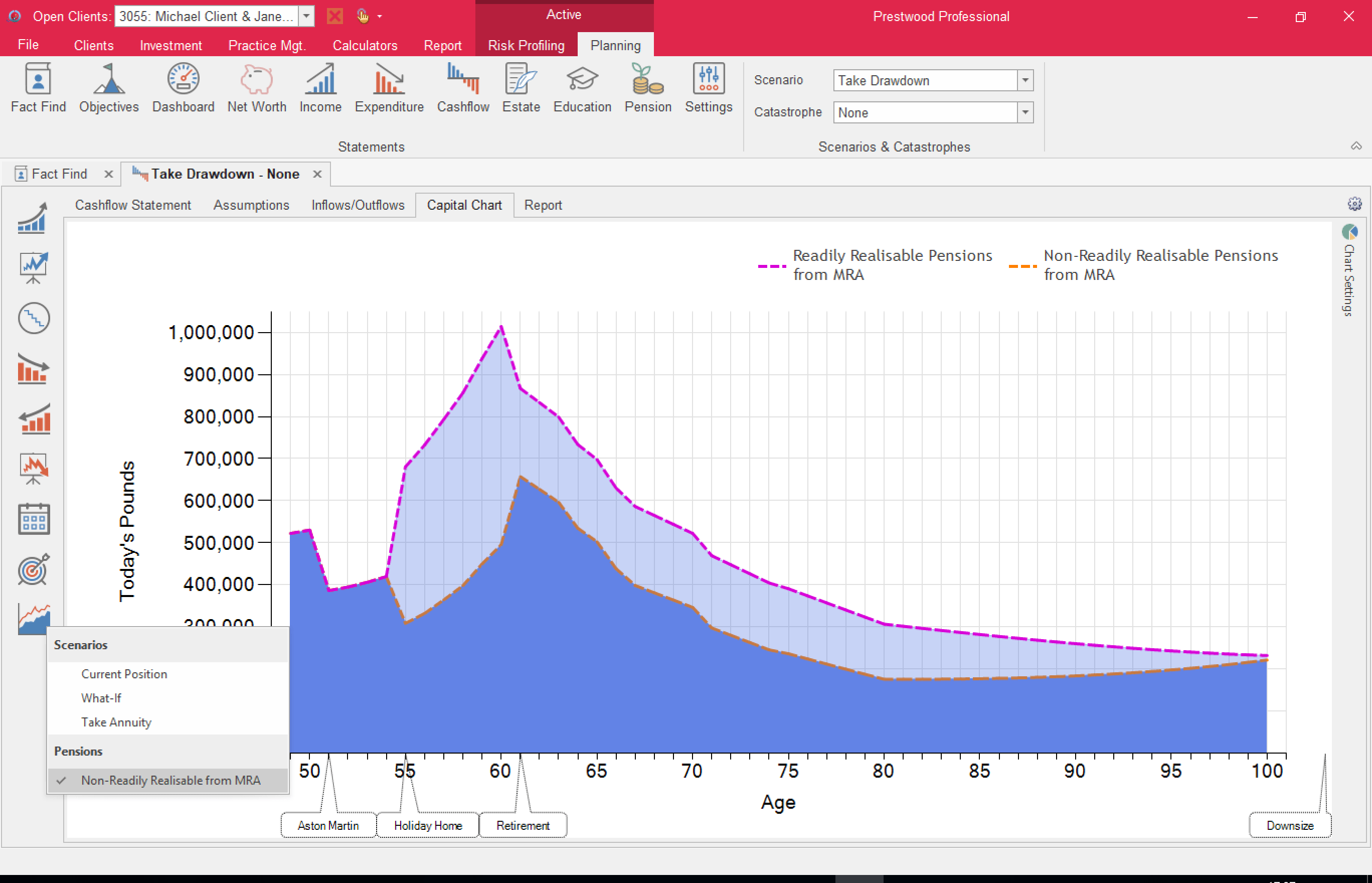

Overlay pensions as liquid assets (29/01/2018)

Toggle pensions as Readily Realisable directly from the Cashflow Chart

Over the last 6 months we’ve made it easier for you to show clients the impact of treating their pensions as either “Readily Realisable” or not, from minimum retirement age.

We’ve now gone a step further: show clients the impact of treating their pensions as liquid assets or not directly from the cashflow! As well as overlaying different modelling Scenarios, the Overlay Charts tool now lets you overlay pensions as “Readily Realisable from MRA”:

N.B. If you’re already showing pensions as Readily Realisable, you’ll have the option to overlay without pensions. If you’re showing pensions as non-readily realisable, you’ll have the option to overlay including pensions.

Irish Budget & MiFID ii (03/01/2018)

Irish Budget 2018

Truth® has been updated with the relevant changes announced during the 10th October 2017 Irish Budget Statement.

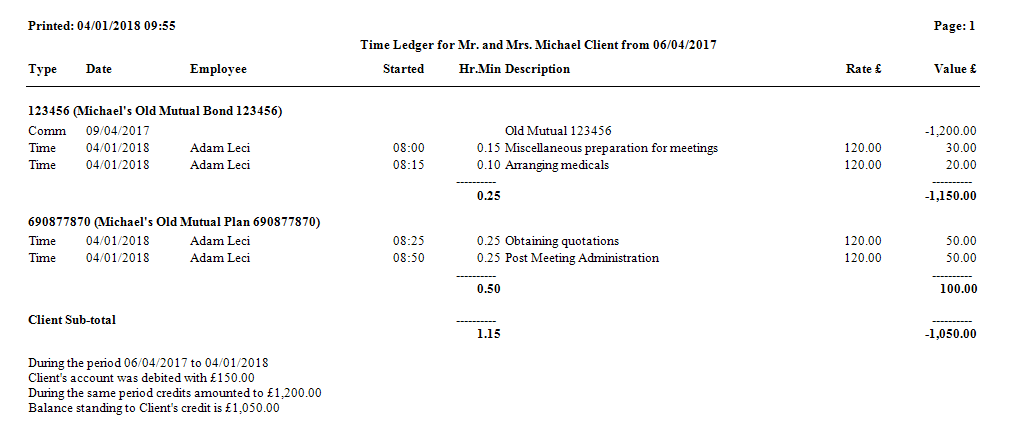

MiFID ii Compliance

We’ve implemented changes for our Pro users to allow analysis of earnings a product-specific basis, to help with their MiFID ii requirements.

Time spent working for a client, as well as any fees and earnings, can now have a “Product Reference” allocated:

![]()

When producing a Client Account Statement, you now have the option to break this down by product, and to include subtotals:

This makes it easy to look at both earnings (fees, commissions, etc.) and costs for the client, on a per-product basis.: