Some of the best known quotes are actually misquotes. The British statistician George E. P. Box once DIDN’T say “all models are wrong, but some are useful”. But the fact he didn’t say it doesn’t make it any less true. Your cashflow model is wrong, but that doesn’t make it any less useful!

Why your cashflow model is wrong…

So you’ve painstakingly fact-found, and fed these elusive facts in to your cashflow modelling software of choice. You’ve assumed assumptions and varied variables until you’re happy with what you see. Your model shows your client has enough money to enjoy the lifestyle they want to lead without running out of money. It shows that they will reach age 100 with £87,206 left in the bank.

There’s a chance (albeit a very small one) that, when your client reaches age 100, this will be their exact bank balance. There’s also a (significantly greater) chance that it won’t be!

What makes your model right is the agreed assumptions you’ve fed in to it. What makes it wrong is the pitfalls you haven’t accounted for:

- What if your client doesn’t reach age 100?

- What if their investments don’t grow as planned?

- What if (and here’s the big one) one of our assumptions doesn’t turn out to be right???

Wrong assumptions aren’t bad assumptions

An assumption you make collaboratively with a client is a good assumption. Your client tells you that they earn £80k a year, escalating at 5% until they retire at 60. You build this into the model. It’s a good assumption. It’s also wrong. Probably!

There’s a huge chance that they won’t get exactly 5% escalation each year until retirement. There’s a chance they will leave their current employment. There’s also a chance they won’t retire on their 60th birthday.

But, providing your assumptions are made WITH the client, not FOR the client, then your model is starting from a solid base.

Telling the present

Cashflow Modelling software is not a crystal ball, and we should take pains not to pretend that it is. It doesn’t tell the future, it helps us to project the present forwards.

Cashflow Modelling software is not a crystal ball, and we should take pains not to pretend that it is. It doesn’t tell the future, it helps us to project the present forwards.

We don’t (and can’t) know what a client’s salary will look like in 5 years’ time, let alone 30 (or even more). What we do know for certain is what they earn now, and what they (or we, collaboratively) think is likely to happen going forwards.

Spurious accuracy?

One comment I hear frequently is this: if we start from the basis that the model is wrong, surely it doesn’t matter if the assumptions you feed in to it are accurate?

I often have conversations with customers that run along these lines:

Customer: My client spends £6,000 a month. They want to spend £4,000 a month in retirement.

Me: OK, where are they intending to save £2,000 a month?

Customer: It’s just what they plan to spend.

Me: Understood, but when they retire will they be cutting back on holidays? Will their commuting costs decrease? Will they spend less, or possibly more, on clothing? How about eating out/hobbies/entertaining…

We’ve already accepted that our cashflow model is wrong. But there are degrees of wrong! If we start out with information that’s incorrect today, we’re not going to end up anywhere near where things are likely to be in 30, 40, or 60 years in the future.

The more accurate you are with your fact-finding, and the better the assumptions you feed in to the model reflect the client’s real plans for their financial future, the more likely it is you’ll be able to project something for them that resembles that future with some degree of accuracy.

The collaborative cashflow

We’ve always advocated cashflow modelling as a collaborative process. Not a service you provide for the client, or a something you do to the client, but a process you engage in with the client.

Some clients don’t want to get into a detailed breakdown of their expenditure. They may tell you that they spend £6,000 a month, and that’s fine. We can feed that information into our model, and show them how their financial future might look. Where cashflow modelling really comes to the fore is when the client takes ownership of the model.

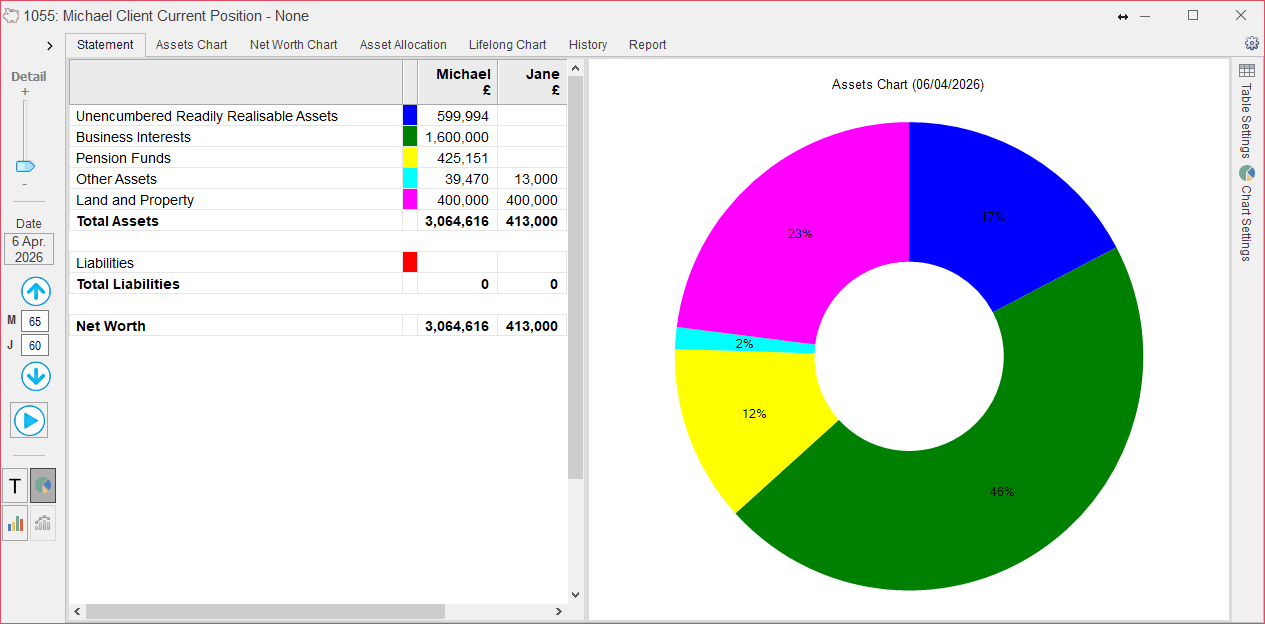

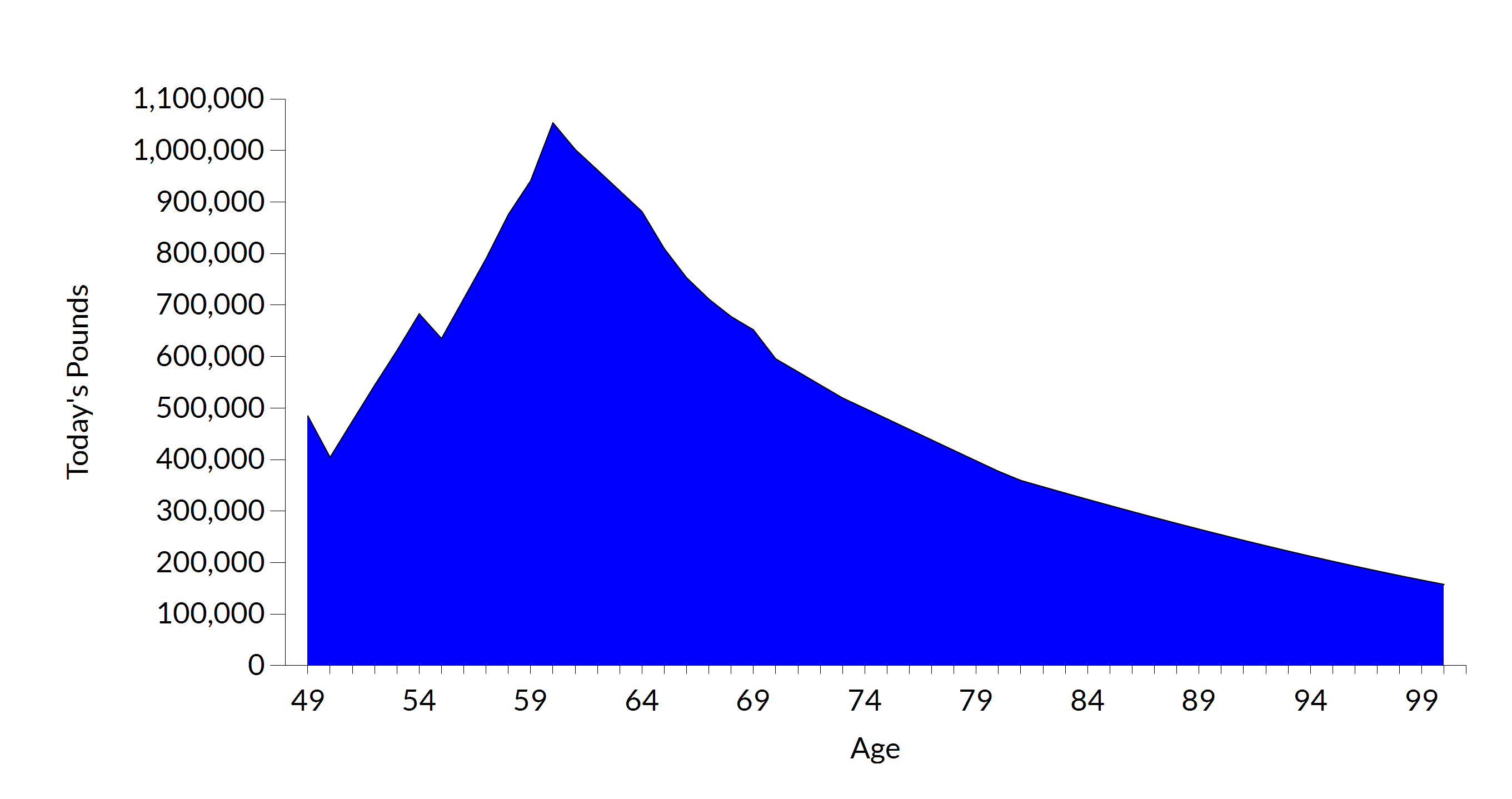

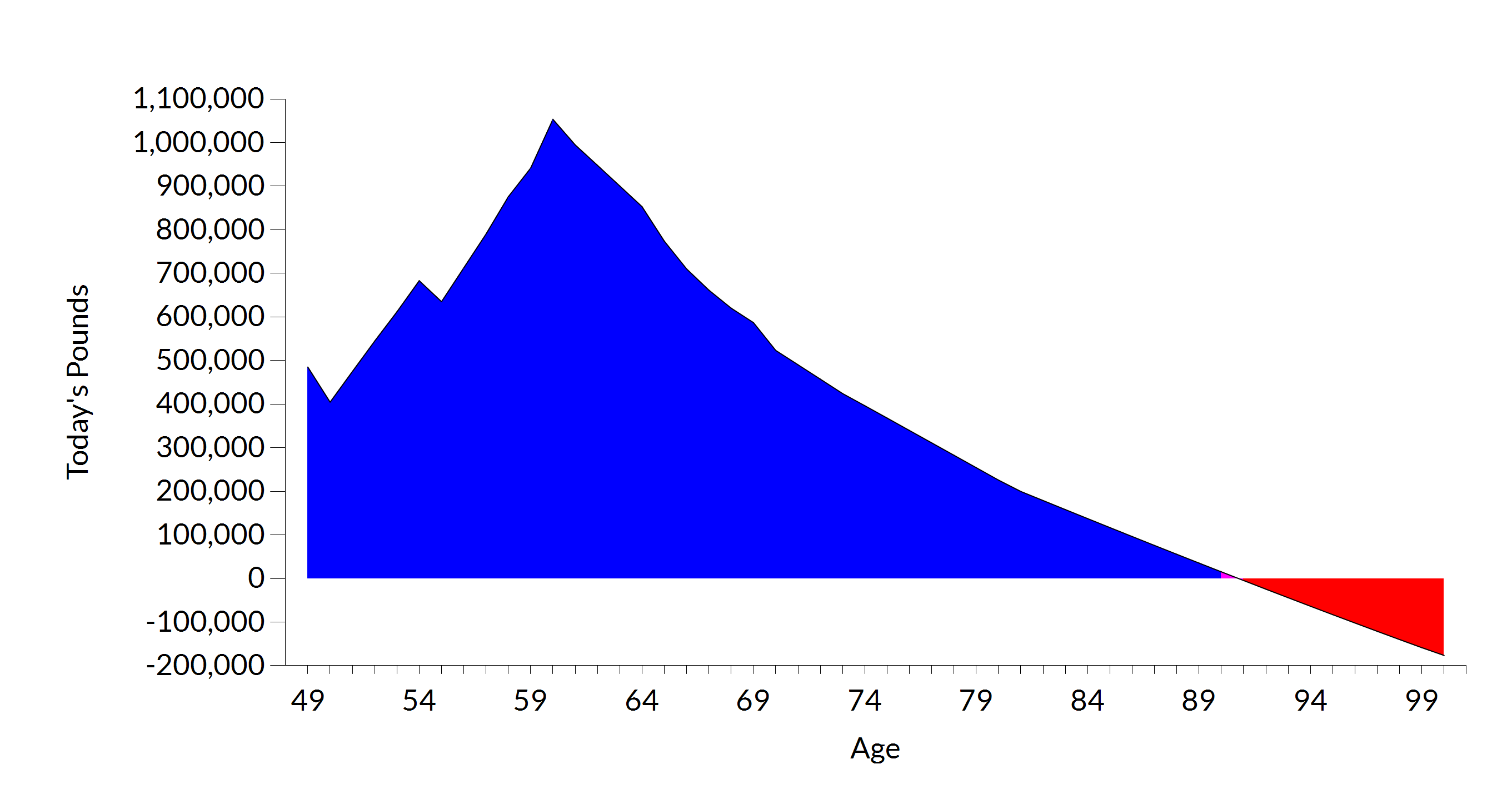

Here’s a Truth Cashflow model. It shows the client’s liquid capital position throughout their life, and whether they have enough money to realise their desired future lifestyle. In this model we’re assuming £6,000 monthly expenditure until retirement, then £4,000:

Here’s the same model with a detailed breakdown of expenditure (totalling a more realistic £4,600 per month in retirement):

Here’s the same model with a detailed breakdown of expenditure (totalling a more realistic £4,600 per month in retirement):

We can see here the significant impact of apparently minor changes, and the importance of building in GOOD wrong assumptions. They’ll still be wrong, but they’ll be significantly less wrong than BAD wrong assumptions!

Taking ownership…

Building on a recent piece by Phil Young for New Model Adviser, clients love cashflow, but we need to do more to help them understand the “levers” they can pull which affect the outcome. The more the clients understand the importance of proper fact-finding, and how assumptions they make today will impact on their cashflow model, the more they take ownership of the process.

Cashflow modelling isn’t a product to be sold to a client, it’s part of a service proposition. It helps clients to visualise their financial future, and reinforces their relationship with you, their adviser. It isn’t a crystal ball, which magically tells you the future – it’s something you collaborate on, year-on-year, and revise and revisit each time you see the client.

Anyone can sell them a pension; a robo can make them a “bespoke” model portfolio… But if clients invest time in making good assumptions, you invest time in helping them do so, and your collaborative cashflow model empowers them to make key decisions with confidence, and to realise their life goals. Then you have a truly engaged client and the basis of a long-term client/adviser relationship.

Yes, the model is still wrong, but it’s certainly useful!