They say that every era has its hero. They also say that sometimes heroes come in unlikely forms…

Whoever “they” are, all we know is that Expenditure Man is here to save your workflows from double-entry and streamline your cashflow modelling!

Coming soon to a cashflow near you…

Well… coming NOW, actually. We’ve been tinkering away for months, working diligently with some of the wonderful planners who use both Intelligent OfficeTM and Truth® to deliver something that allows you seamlessly to import not only assets, income, and policy details, but also all the expenditure details your clients have input into the Personal Finance Portal.

Whether it’s their gym membership or their council tax bill – if it’s in iO, it’s now in Truth. We’ve always imported policy premiums and investments but, in many ways, this is the “missing link” in terms of being able to import data from iO directly into Truth and go straight into planning mode.

Help me, Expenditure Man, you’re my only hope!

We’ve talked about it before – expenditure is the key differentiator that really helps the narrative of your clients’ lives shine through in their cashflow. By populating this data via our API integration with Intelligent Office, you can start with an idea of what your clients are spending NOW and spend your time and efforts focussing instead on what they want to spend in the future.

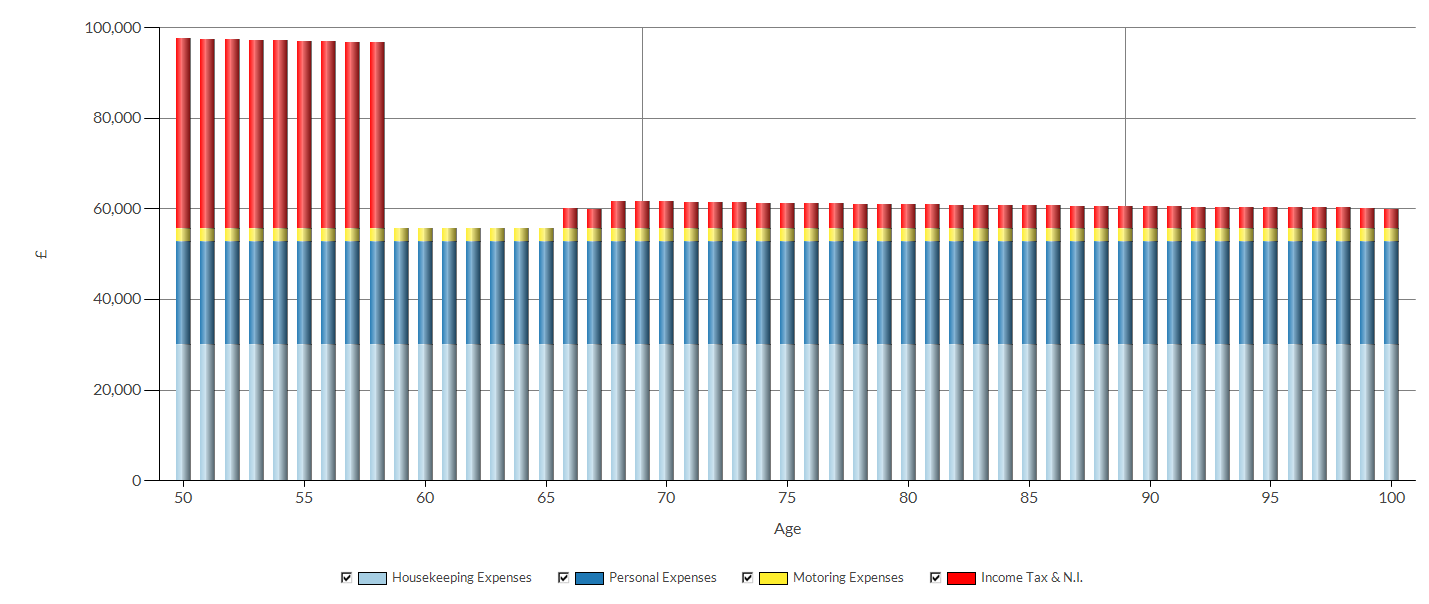

You can find more information on the hows and the whys and the wherefores in our user guide – here we’re going to focus on the outcomes for you and for your clients! After initially deciding how to categorise expenditure that comes in from iO (a one-off decision which you can revisit as needed), you’re left with something like this…

So what? I hear you say!

So – you’ve done nothing, so far, in terms of producing a cashflow. And yet, you have enough data to produce one.

What is this chart? An excellent question! It’s the client’s Lifelong Expenditure, in today’s pounds. It shows what they anticipate spending for each year for the rest of their lives.

With that out of the way, the first thing you’ll notice is that their spending never changes. This is where you come in…

Now we’re getting personal!

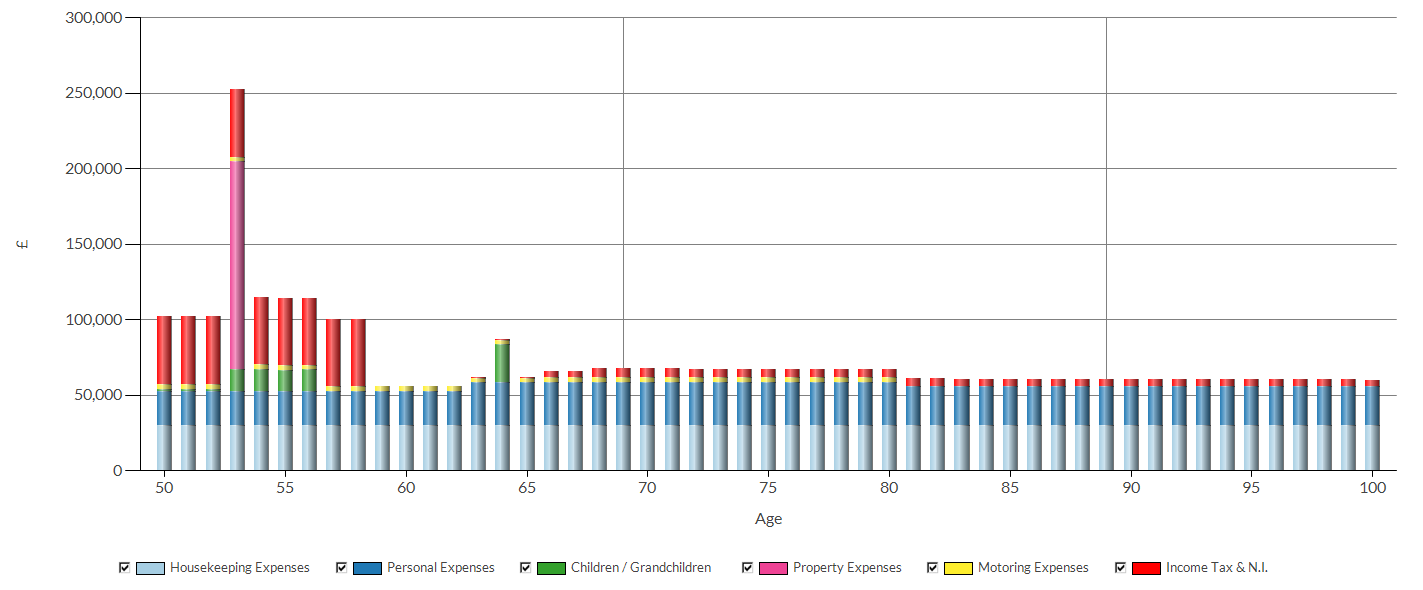

What do your clients want to do with the rest of their lives? Do they really intend to carry on driving until they’re 100 years old? What about the kids? They’re just starting secondary school now, but someday there will be university fees and wedding costs…

With a few quick tweaks, we can produce something a bit more like this:

We’re using the same basic data, but I’ve added some spending on the kids (green) over the next few years. Some uni fees after that, and a wedding when their daughter gets to age 30 (there’s no harm in planning ahead!). My clients also want to buy a holiday home in a few years time, so I’ve built that into my model. They want to spend more on personal expenses, like holidays, in retirement. And I’ve stopped their motoring expenses at age 80.

It’s far from the world’s most complicated cashflow model, but it’s taken less than 5 minutes to produce. More importantly, it’s starting to reflect my client’s actual desired retirement lifestyle. This makes the cashflow model we produce infinitely more useful as a decision-making tool.

Lifestyle choices…

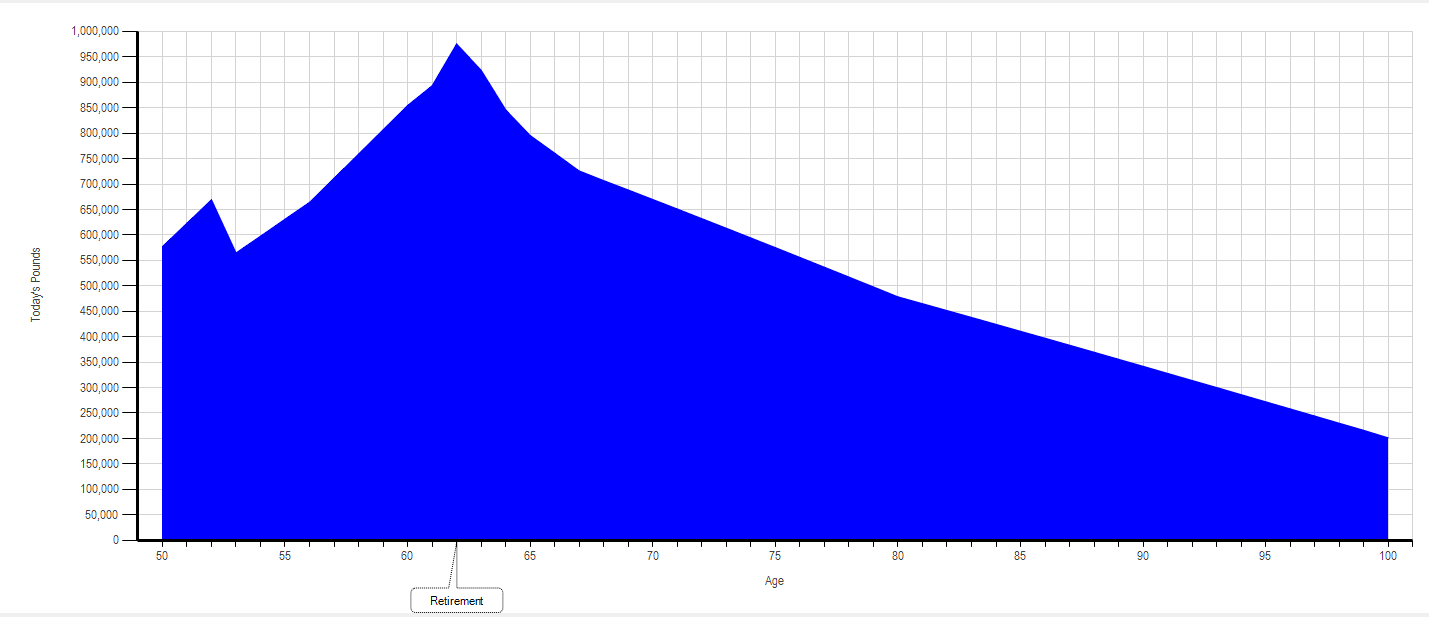

I’m sure you’re all keen to see my clients’ cashflow, so here it is:

This chart shows their liquid capital, in today’s pounds, for the rest of their lives. They can afford to buy that holiday home in a few years. They can afford the uni fees and the wedding. They can even afford the more expensive holidays in retirement.

Now it’s time to see what else they can do with the rest of their lives. Maybe they could retire earlier? Maybe they could spend more (or give more away)? The world is, quite literally, their oyster.