You asked, we delivered…

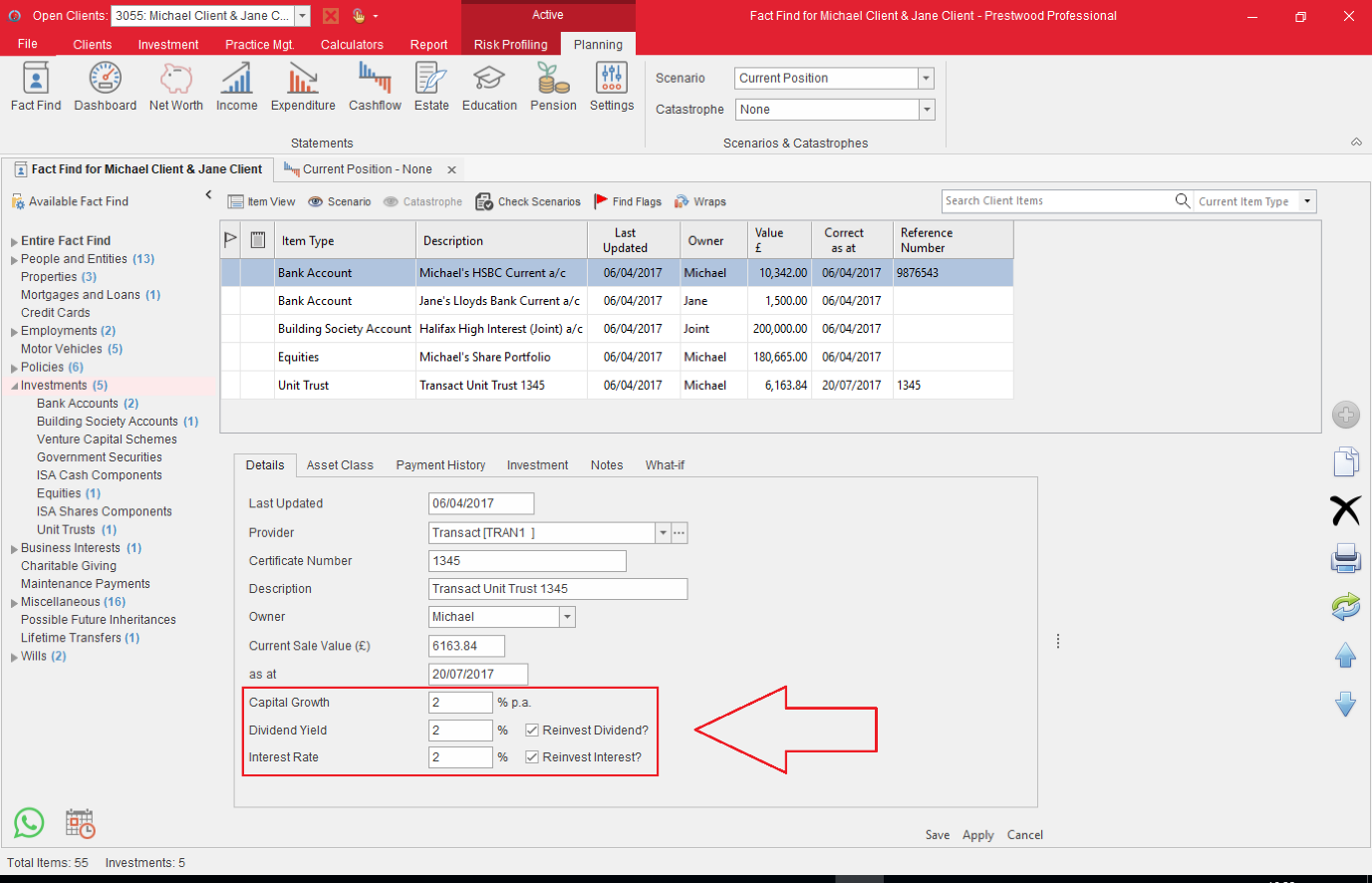

As part of the July 2017 Truth Software Update to our back-office and lifelong cash flow modelling tools, we’ve introduced changes to the Unit Trust item. You can now model separate streams of income from Unit Trusts, as well as reinvesting income back in to the product.

This change comes as a direct result of customer feedback, along with a host of other fixes, tweaks, and improvements which will improve your user experience and help you deliver better client outcomes.

More accurate tax position

Now in the Unit Trust item, you can distinguish between Capital Growth, Savings and Dividends:

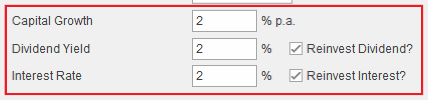

Capital Growth allows you to specify the rate by which the capital in the Unit Trust will appreciate.

Dividend Yield allows you to specify a rate of dividend income from the Unit Trust, taking advantage of any tax-free dividend allowance the client may have remaining. This may be applicable if the Unit Trust contains collective investments, OEICs, Unit Trusts, or directly-owned shares.

Interest Rate allows you to specify a rate of savings income generated by the Unit Trust, taking advantage of any Personal Savings Allowance the client may have remaining. This may be applicable if the Unit Trust contains corporate bonds, gilts, cash, or fixed-interest securities.

Reinvest income?

With the latter two, you have the option to automatically reinvest income into the Unit Trust. This means your client’s tax position is correct (as we’ve treated the dividends or interest as income), and the balance of their Unit Trust will show the result of the reinvested proceeds.

If you would like any further information, please contact our support team.