A few weeks ago the FCA published a consultation paper about pension transfer advice, contingent charging, and other proposed changes. We thought we should take a look because it referred to the use of cashflow modelling in pension transfer advice.

So we did. What we saw was music to our ears (or eyes?)!

What the FCA say about Cashflow Modelling

Cutting to the chase, here’s what CP 19/25 says about the use of cashflow modelling in pension transfer advice:

Our supervisory work has identified some areas where cashflow modelling has been used in a way that could be misleading. These include the use of nominal terms cashflows without explaining inflation, a lack of indexation of tax bands or tax limits, and no consideration of market downturns. As a result, advisers may be giving clients unrealistic expectations of future income.

They then go on to break this down into key areas that cashflow providers need to address. Before I look at those in more detail, let’s itemise the issues that the FCA’s supervisory work has picked up on as potentially misleading, and how Truth® handles each of these issues:

- “the use of nominal terms cashflows” – our cashflow is always in today’s/real terms, and always has been!

- “a lack of indexation of tax bands or tax limits” – all tax bands are indexed by inflation in Truth® unless there’s legislation in place which states otherwise

- “no consideration of market downturns” – Truth®‘s cashflow has a dedicated tool for just this job!

In other words (spoiler alert) we won’t be changing anything in readiness for whatever new guidance is published in response to the consultation paper because we’re already doing it all!

“How will you be making your software compliant?”

We were approached last week by a major provider of support services for IFAs to find out how we will be making our software compliant with the proposed new rules. We were delighted to tell them we didn’t have to and broke down for them why this was the case. That email prompted this blog!

Going into a little more detail, here’s what the FCA is proposing:

To address the shortcomings we have seen in cashflow modelling in the APTA, we are proposing the following new rules if firms choose to use cashflow modelling:

- Firms must prepare cashflow models in real terms, ie in today’s money terms. This will ensure that the models are consistent with other mandated documents such as Key Features Illustrations (KFIs).

- Firms must ensure that tax bands and tax limits are set using reasonable assumptions if they model net income from year to year. The use of real terms’ modelling should facilitate appropriate indexation.

- The model should explicitly allow for taxes or constraints that are likely to arise on a transfer that would not occur if safeguarded benefits were retained, such as a Lifetime Allowance charge, any tax applicable on the death of the consumer, or the application of the money purchase annual allowance.

- The modelling must include ‘stress testing’ scenarios to illustrate the impact of less favourable future scenarios so that the consumer can see more than one potential outcome.

If you’re a Truth® user, or considering using Truth® for producing your cashflow models, here’s what you need to know:

“Firms must prepare cashflow models in real terms, ie in today’s money terms”

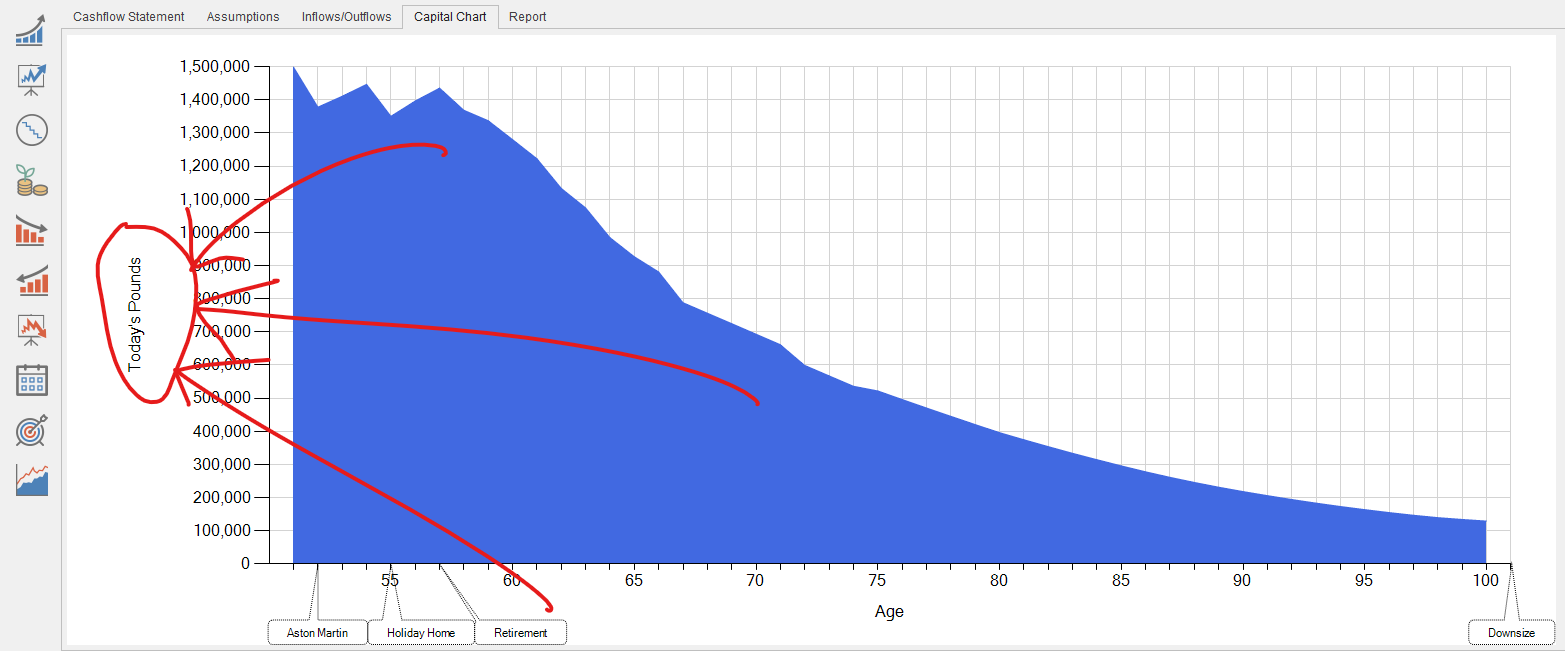

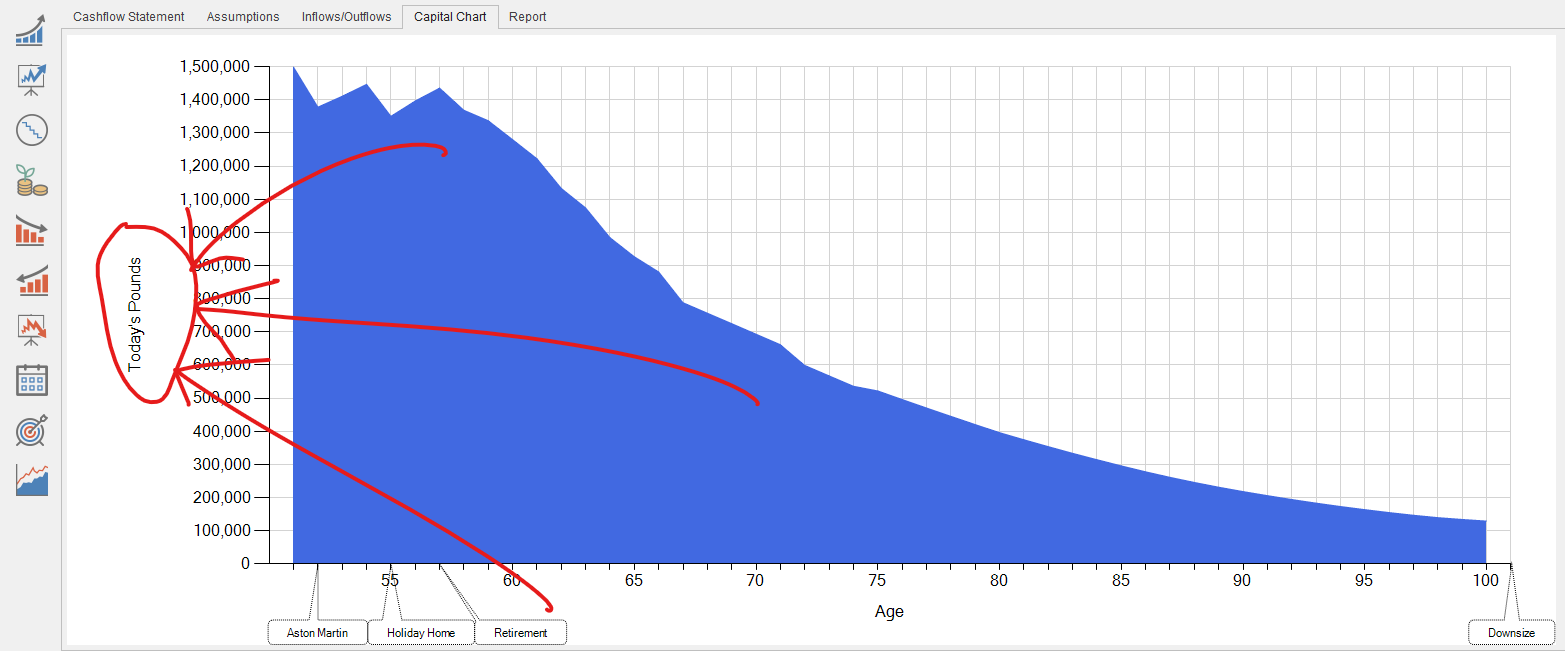

Truth® cashflows are always in Today’s Terms. They always have been, and always will be! This is because we find Today’s Terms cashflows eliminate ambiguity, and show clients what their money might be worth (in terms of spending power), relative to inflation.

Truth® cashflows are always in Today’s Terms. They always have been, and always will be! This is because we find Today’s Terms cashflows eliminate ambiguity, and show clients what their money might be worth (in terms of spending power), relative to inflation.

I won’t labour the next point – we’ve already covered it. We index all tax bands and allowances with inflation unless legislation states otherwise. We don’t model net income, we want all your gross figures, and will calculate any tax for you. This includes National Insurance disappearing at State Pension age; tapering of allowances for higher-rate and additional rate taxpayers; sharing allowances between married couples, etc., etc.

I’m sure I said I wasn’t going to labour the point?!

“The model should explicitly allow for taxes or constraints that are likely to arise on a transfer”

As I said: music to our ears!

One of the things we constantly emphasise both to our existing customers and prospective ones is that they can simply change pension benefits, and Truth® deals with everything else.

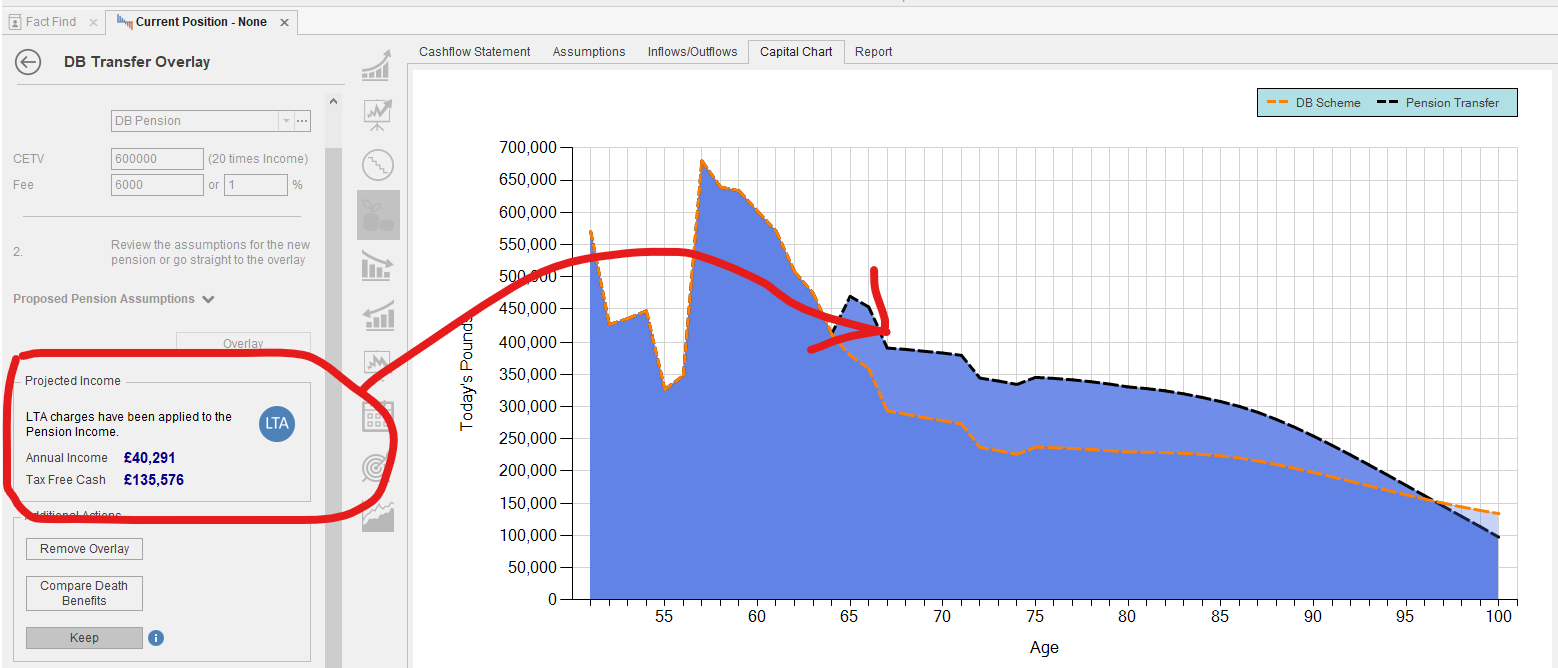

Even when using our dynamic cashflow tools in Truth® to look at hypothetical modelling exercises with a client during a meeting (such as topping up Annual Allowance, looking at a DB pension transfer, etc.), Truth® will factor in the impact of any potential Lifetime Allowance charges. Of course, as ever, we’re taking into account changes to their income tax position; national insurance; personal savings allowance…

The DB transfer tool gives you the option to overlay a comparison of death benefits. On death, of course, we’re factoring in the client’s marital status (and their partner’s, assuming they aren’t bigamous!); any widow’s carry-over nil-rate band and residence nil-rate band; tapering to the RNRB; the client’s age on date of death (i.e. whether income is or isn’t taxable); the surviving partner’s tax and NI position…

All you need to do is enter a CETV and click the “Overlay” button.

“The modelling must include ‘stress testing’ scenarios”

I won’t spend too much time on this point, as we’ve already addressed this at length in a previous blog (”

Why Your DB Transfer Cashflows NEED To Use Our Market Crash Simulator…”). In summary:

“As the old saying goes: “hope for the best, plan for the worst”. Although we’re hoping for x% growth (on average), and a long, happy, healthy retirement, planners should at the very least make clients aware of what could happen.

Truth® can help clients visualise the impact of “the worst”, and so helps you plan for it.”

But when we talk about stress-testing in Truth®, we’re not only talking about market crashes. Our software provides you with a variety of tools to stress-test your scenarios. This includes four in-built catastrophes looking at the potential impact of death or disability of either client or partner. In the specific case of pension transfers, this allows you to highlight to your clients the difference between the death and disability benefits from their DB scheme, and the fund they would have access to if they transferred. You can, of course, choose how those death benefits are paid out (i.e. as a lump-sum; dependent’s drawdown; dependent’s annuity), and Truth® will deal with any tax implications for you.

In summary

What will we be changing, in readiness for CP19/25? We’re incredibly proud to say: “nothing”!

Our software has the benefit of 35 years’ development behind it, all driven by our focus on providing accurate and detailed calculations, and directed by the feedback of our customers. If you’re using Truth® for your pension transfer cashflows, you can rest assured that your model is compliant with any changes that may be around the corner. We haven’t made any changes, it’s just the way we’ve always done things.