Truth Software Release Notes 2022

Details of changes to our back office and Cashflow Modelling software

Tax Year Update (05/04/2022)

We’ve updated Truth Software to reflect the recent changes announced in the Chancellor’s Spring Statement. The highlights are as follows:-

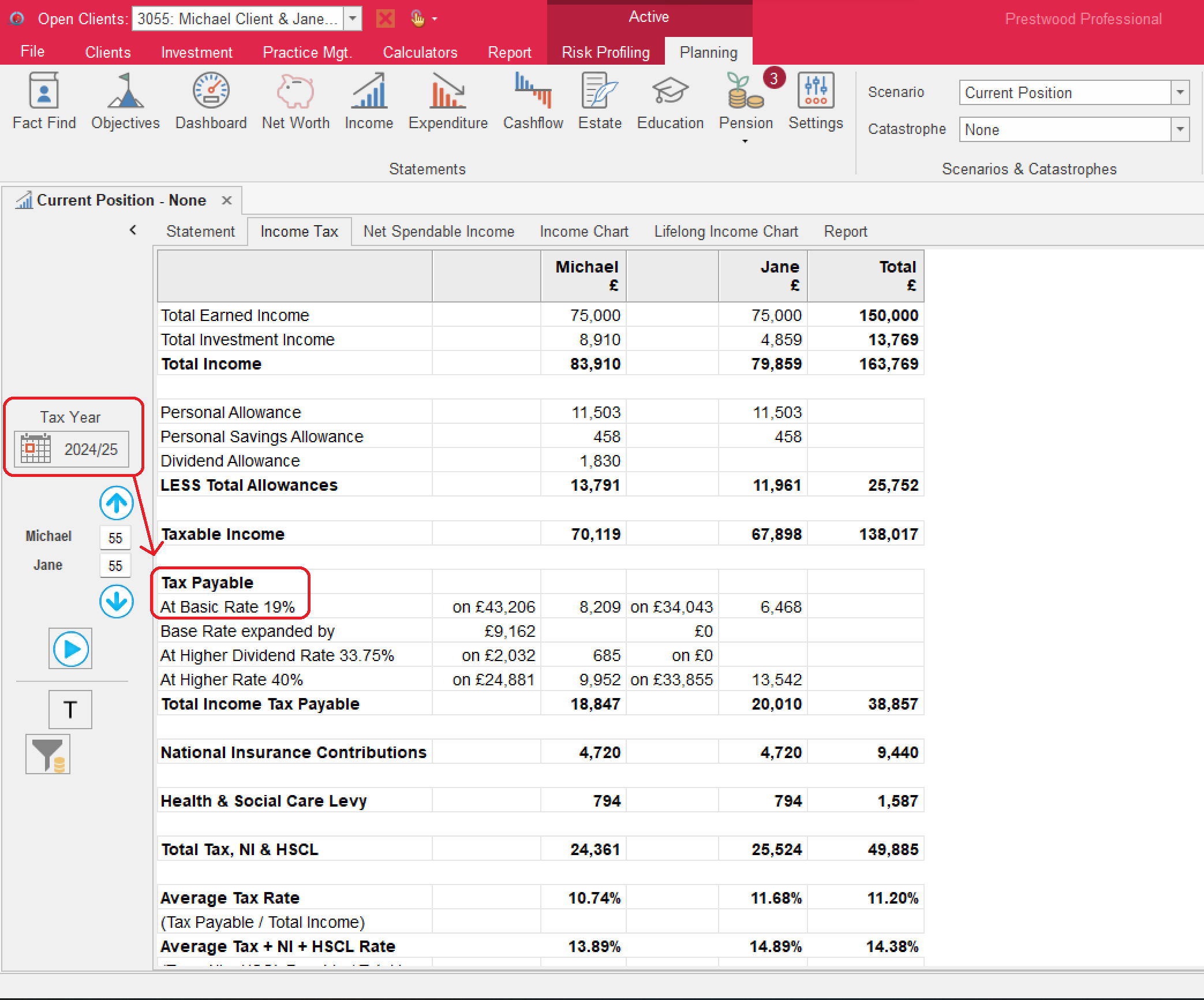

Reduction in Basic Rate Tax Rate

From the 2024/25 tax year, the Basic Rate of Income Tax will be reduced from 20% to 19%. From the same date, Basic Rate taxpayers will also be reduced to 19% pensions tax relief, including those governed by the Scottish Rate of Income Tax (SRIT).

This has been introduced to all relevant planning statements.

In case you missed it from the Chancellor’s Autumn Statement:-

- The rate of National Insurance has been increased by 1.25% exclusively for the 2022/23 tax year.

- The rates of taxation on Dividend Income have been increased by 1.25% from the 2022/23 tax year.

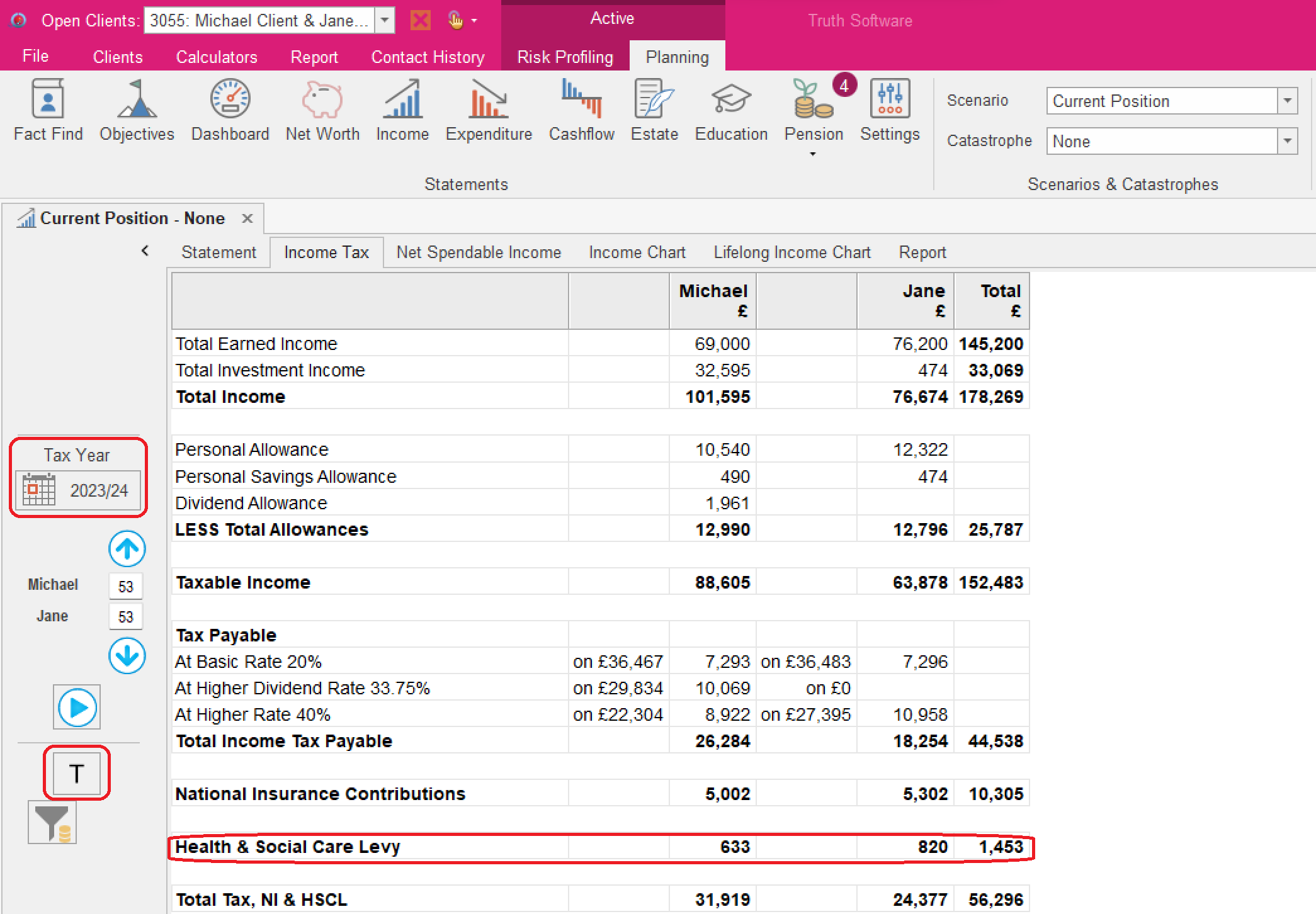

- The Health & Social Care Levy (HSCL) has been applied from the 2023/24 tax year.

All these charts and tables can now be viewed in today’s or actual terms.