One of the questions we get a lot is: “why does my business need cashflow modelling software?”

We think it’s a really easy question to answer – it helps empower clients to make informed decisions about their financial futures.

There you go. Shortest blog ever.

…

OK, I’m assuming you’re looking for a little justification of this somewhat bold claim. In this blog, we’ll look at 5 symptoms that might indicate you need to review your business’s use of Cashflow Modelling software:

- You struggle to get referrals

- Clients question the value of your advice

- You’re worried about future complaints

- You’re spending hours doing manual calculations

- Your client review processes are inconsistent

Let’s address each of these symptoms in turn: look at what they might mean for your business, and how cashflow modelling can help.

You struggle to get referrals

Picture this: you’ve spent a dozen hours over a 2-week period considering a client’s pension situation. You’ve made some carefully-considered recommendations and the client seems happy. But it stops there. Maybe you make an appointment for another meeting; maybe not.

Our customers tell us the biggest difference they notice after incorporating cashflow modelling into their business is increased client engagement. Often clients will politely nod their way through a planning meeting. Using Cashflow modelling within your business in a way that challenges clients and questions their assumptions about their financial futures forces them to sit up and take notice.

In a recent blog, we looked at how increasing the detail in your cashflow model increases engagement. Your model stops being generic and starts to become a narrative of your clients’ lives. Clients understand that they’re pulling the strings of a dynamic model which you can change together. They aren’t looking at a static report.

Once your clients understand the need to provide all that juicy detail, not only about their bills and expenses but about their future life goals and ambitions, they become empowered to make important and informed decisions about their financial futures and (perhaps more importantly) invested in the process. You impress on them how important it is to revisit the plan on a regular basis and before they leave your office they’ve made an appointment for their next meeting. They become enthused not just by the outcome, but by the advice process itself!

This doesn’t only make your relationships with your existing clients stickier, it will help you find new clients organically. Who’s more likely to provide positive referrals: the client you sold a new life policy to, or the client with whom you had a 4-hour meeting helping them understand when they can afford to retire, and what that retirement might look like?

Clients question the value of your advice

When you tell your clients you’re going to be taking X% of their investment growth, or charging them £Y for giving them advice, how do they react?

We asked some of our most successful customers how they combat this and they told us that they focus on “lifelong financial planning” rather than selling products. Cashflow modelling underpins this business proposition by providing simple visuals which offer clarity and peace of mind to their clients. They don’t tell clients they’ll get them better growth on their GIA, or that they should transfer their ISAs to the adviser’s chosen platform. This may or may not happen as a result of the process.

It’s impossible to compete with robo-advisers who can match clients with a portfolio for a few basis points. We need to focus on the human aspect of advice – the bit that can’t be offered by artificial intelligence and algorithms. In our experience this comes from inspiring confidence in your clients. A simple answer to a simple question, backed up with comprehensive stress testing, is more powerful than a hundred pages of figures. Telling clients they’re OK is one thing, but showing them is a different matter. You can demonstrate that they can maintain their lifestyle even in the rough seas of adverse market conditions, poor investment performance, or if they were to need long term care. Suddenly they’re not just empowered and enthused, but also confident! They understand you’ve pre-empted even the worst-case scenarios for them.

When you align your interests with your clients for your mutual benefit you create a great relationship. You create a human bond that has a tangible value to the client. This is worth infinitely more than a few pennies on the pound and cost becomes irrelevant.

You’re worried about future complaints

Aren’t we all?

It’s a sad truth that we live in a litigious society. When things don’t go the way we anticipated the default question is no longer “what did I do wrong?” but rather “who can I blame?”

I’m sorry to say that cashflow modelling isn’t a magic umbrella which will protect you from any potential future complaints. What it IS is a fantastic audit trail of what you discussed with your client; what you recommended, and why.

Going back to my points above – the process is all about informing, educating, and empowering clients. We’ve always advocated cashflow modelling as a collaborative process. Not a service you provide for the client, or a something you do to the client, but a process you engage in with the client. If clients are genuinely engaged with and involved in the advice process, buy into the importance of providing accurate information and the value of ongoing reviews, they have far less ground to complain when something goes wrong.

Our cashflow modelling software is amongst the most comprehensive and detailed tools on the market. Some see this as a weakness; we see it as a strength. A customer who recently signed up for Truth® told me about an experience they recently had at a conference. One of their peers was trying to persuade them to use a more basic cashflow tool and their gambit was “my cashflow software is so simple to use that my 7-year-old daughter can use it”. To which the adviser replied “I wouldn’t want my clients retiring on the back of a system that can be piloted by a 7-year-old”!

Cashflow modelling doesn’t have to be complicated. Using a system that can handle the complexity of your clients’ individual situation and helps them engage in a real way with the advice process offers the best protection possible against whatever the future may hold. And PI insurers like it, too!

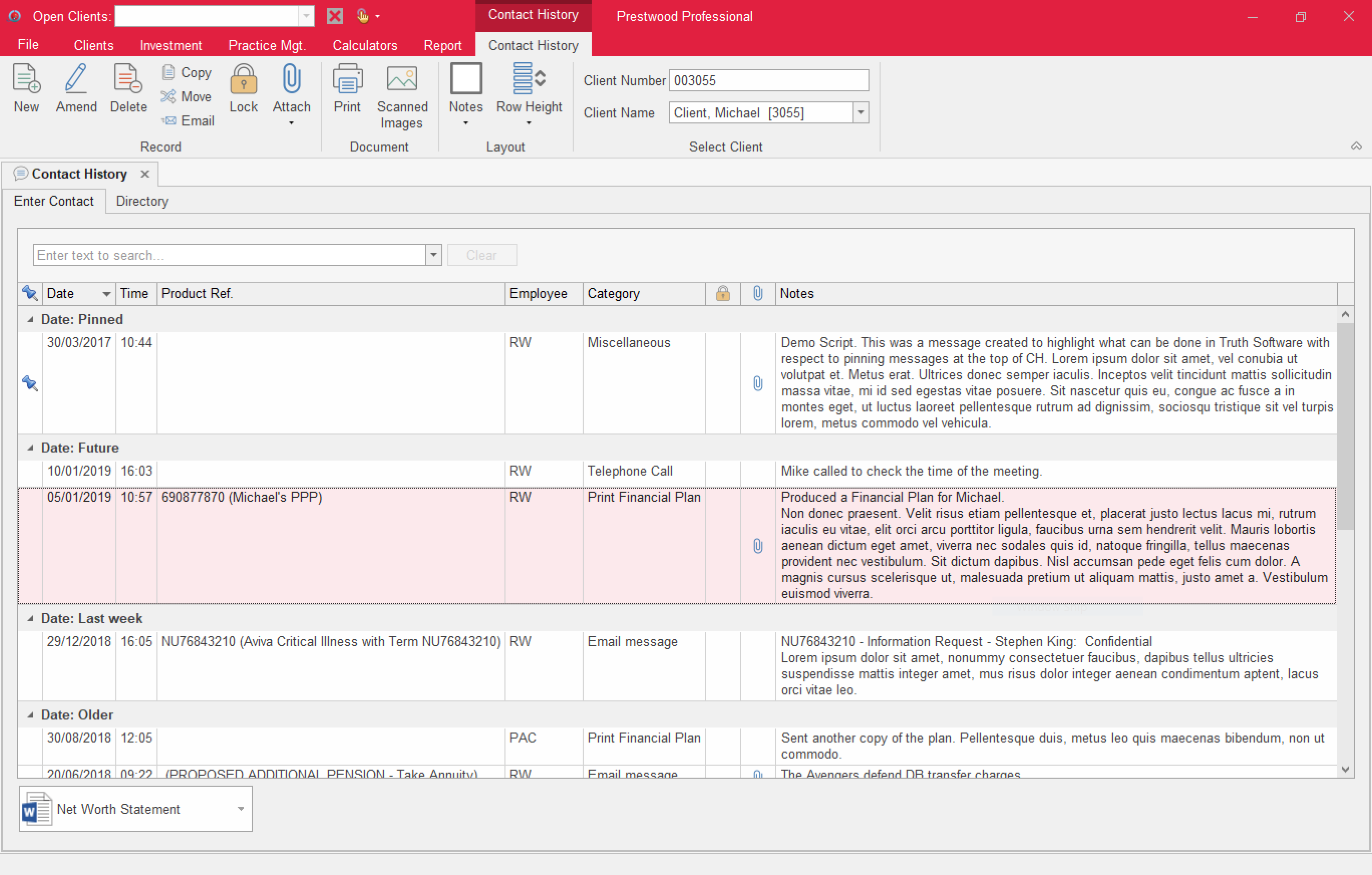

If you had an FCA visit how would you want your “perfect” client file to look? It’s worth noting that Truth includes a Contact History module, which allows you to record all your client touchpoints from all sources, as well as securely store documents and emails.

You’re spending hours doing manual calculations

When a client has a complicated history of contributions to a variety of DB and DC pensions with different pension input periods and is subject to a tapered Annual Allowance due to their earnings, how do you work out what carry-forward they have available?

If a client is considering various different ways of drawing money from their assets moving forward and wants to see the impact on their holistic position including any relevant income tax, National Insurance, and Lifetime Allowance charges, how do you show them this?

I could give countless examples. The important thing is that if any element of your answer involves a pen, paper, calculator, or spreadsheet this is a good sign that your business needs proper cashflow modelling software!

We’ve been developing our software for over 35 years based entirely on customer feedback. It’s not perfect, but it’s designed specifically to answer these kinds of questions for your clients with minimal fuss. If your client wants to look (for example) at a completely different strategy during a meeting you shouldn’t have to tell them you’ll get back to them in a week with fresh calculations. A good cashflow tool will allow you simply to change assumptions live in front of the client, and automatically update all those complex tax calculations at a click of a button.

Yes, there are some tools which don’t do all of these calculations for you. If you’re still using a pen and paper, or an Excel spreadsheet, to supplement software you’re paying for maybe it’s time to reevaluate?

Your client review processes are inconsistent

Paul Etheridge, founder of Prestwood Software and founding member of the Institute of Financial Planning (now part of CISI) has a saying:

Avoid having unique thoughts in routine situations

Whether you’re seeing 200 clients a year or 20, having repeatable and consistent processes is key to running an efficient and profitable business. If you’re reinventing the wheel for each client review it will inevitably take you far more time and energy, and will cost you money. Your cashflow tool should support and facilitate this.

With a comprehensive cashflow tool such as Truth there are a wealth of charts and statements, each of which can help you to enlighten your clients. We encourage customers to develop their own “route” around our software. The journey which clients go on you during a meeting should be something that is familiar and comfortable for you, but also something that works for your customers.

Our regional User Groups, which run regularly across the country, feature case studies delivered by our customers. In the feedback from these groups, we often hear that attendees have discovered new and useful features in our software which they’ll be incorporating into their meeting process moving forward.

Our regional User Groups, which run regularly across the country, feature case studies delivered by our customers. In the feedback from these groups, we often hear that attendees have discovered new and useful features in our software which they’ll be incorporating into their meeting process moving forward.

Once you have your meeting sculpted around your cashflow tool you have the formula for a repeatable and consistent client experience. The “oohs” and “aahs” will inevitably come at the same points, and you’ll know which tools and buttons to use to fix the “aarghs”!

So you’ve had your meeting, what next? Do you write each client report manually? Do you incorporate screenshots from your existing software? Does your report reflect your brand and corporate identity? Your cashflow tool should allow you to create simple and customisable reports, incorporating the charts you looked at in your meeting, the figures you discussed, and your own suitability wording.

Maintaining simple, repeatable processes helps deliver better and more consistent client outcomes.

The important thing to bear in mind is that the tools you use should help you to empower clients. The end goal of financial planning is helping the client realise their future lifestyle goals, whatever these goals might be. Cashflow modelling can help you answer some really complex questions with ease, resulting in empowered, enthused, engaged clients and a business which delivers consistently fantastic client outcomes!

If any of these symptoms apply to your business then maybe it’s time to take a close look at cashflow modelling software?