We’ve updated Truth Software to reflect all changes from the Autumn Budget. You can use the following links to jump to the key changes:

Clarification of Income Statement

Additional Rate Threshold lowered

Lifetime Allowance freeze extended

Clarification of Income Statement

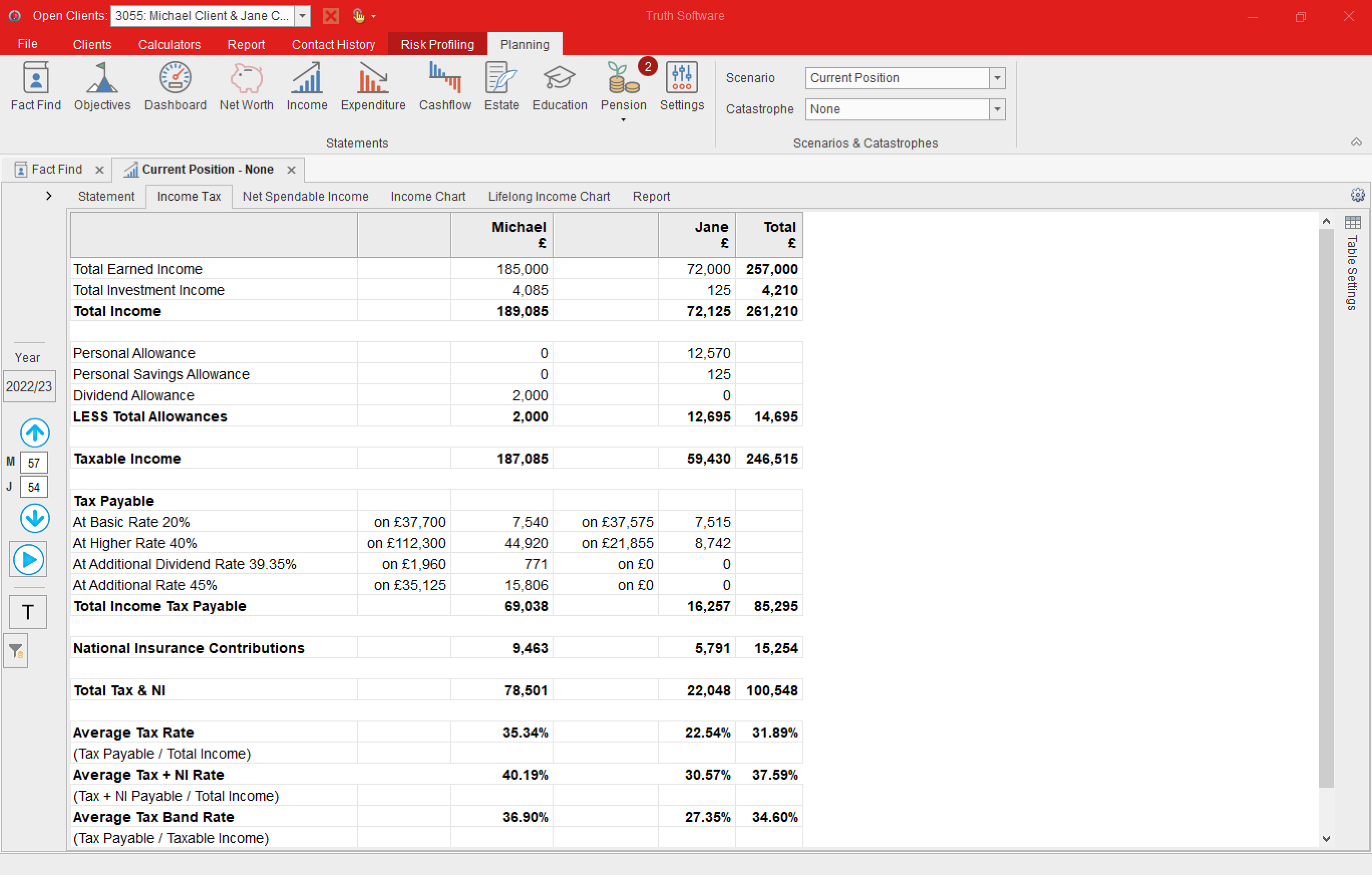

The calculations on the Income Statement previously displayed rates of tax in escalating order, i.e. all income taxed at 20% was grouped together. In some cases, this could make it difficult to differentiate Non-Savings, Savings, and Dividend income.

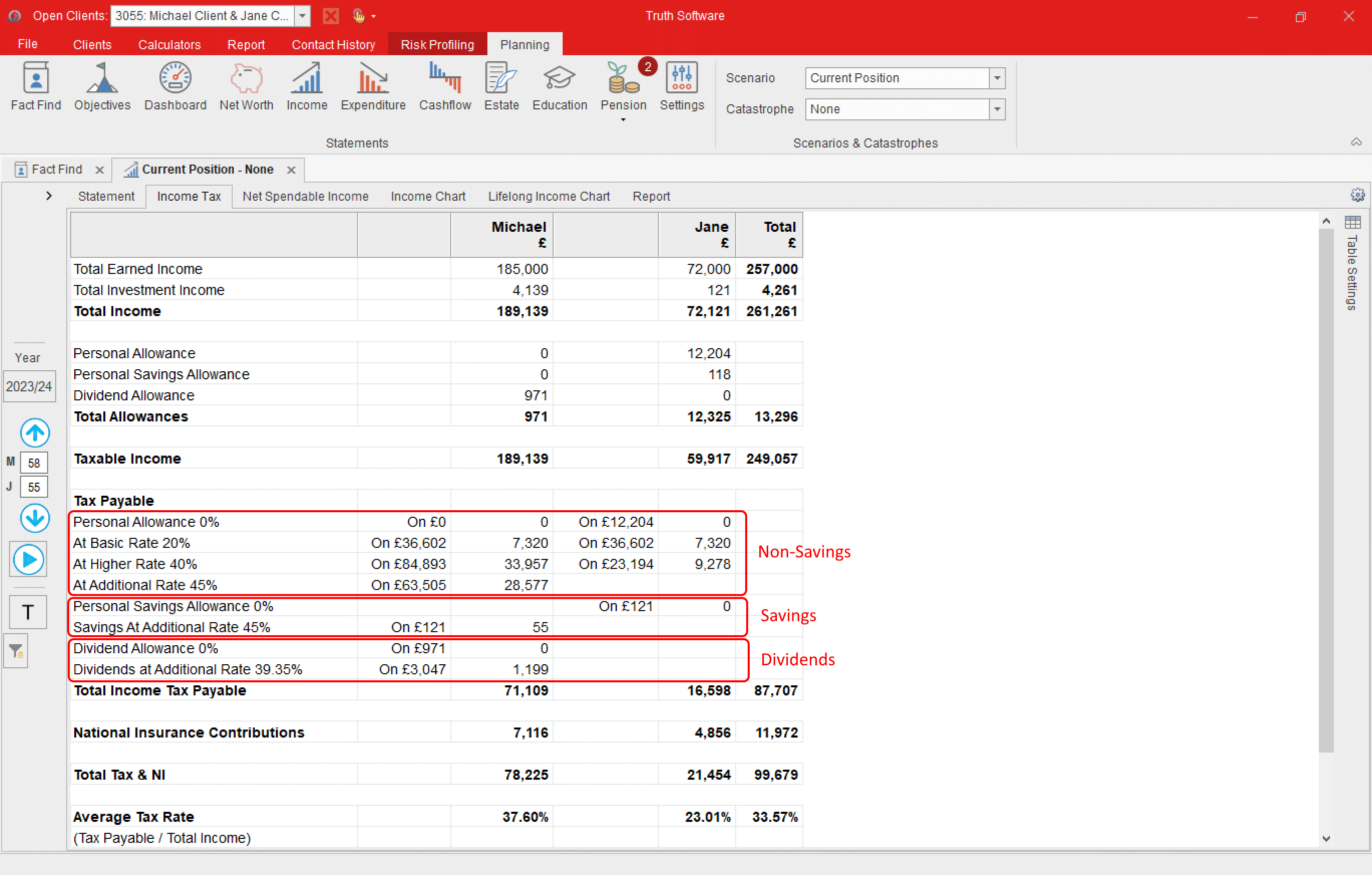

The Income Statement now displays income in the order it is calculated by HMRC: Non-Savings, then Savings, then Dividend income. Allowances that are applied to each income type are also clearly displayed:

Old Income Statement:

Improved layout:

All changes apply both to on-screen and printed statements.

All changes apply both to on-screen and printed statements.

National Insurance changes

The Autumn Statement included a number of changes to National Insurance policy, all of which have been incorporated into Truth®. This includes:

- All National Insurance thresholds have been frozen until 06/04/2028 (thereafter, they will increase with your specified Inflation rate)

- 1.25% National Insurance increase applied on a pro-rated basis for 7 months from April to November 2022

- National Insurance rates will revert to their old values from 2023 onwards

- The Health and Social Care Levy (HSCL) has been removed from all statements

You can view the Gov.UK policy statement here.

Additional Rate threshold lowered

From April 2023, the Additional Rate tax threshold has been lowered from £150,000 to £125,140. This will then be frozen until April 2028, when it will start to increase with your specified Inflation rate.

You can view the Gov.UK policy statement here.

Back to top

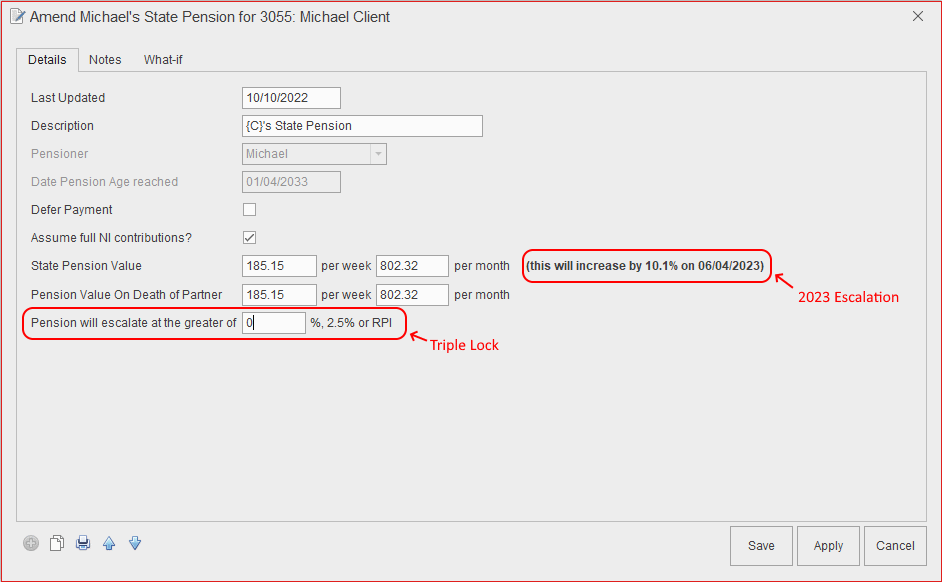

State Pension changes

The State Pension item has the Government’s Triple Lock already built into it, allowing you to index State Pension income at the greater of 2.5%, RPI, and AER. In line with the Autumn Statement, State Pensions will increase at a rate of 10.1%, reflecting September 2022 inflation rates:

Dividend Allowance changes

Dividend allowances are reduced from a maximum of £2,000 to a maximum of £1,000 from April 2023. From April 2024 onwards, these are further reduced to a maximum of £500.

See more detail on this policy change on Gov.UK here.

Lifetime Allowance freeze extended

Along with other tax rates and allowances, the Lifetime Allowance has been frozen at its current rate of £1,073,100 until April 2028. From that date onwards, the Lifetime Allowance will increase with your specified Inflation rate.